In the fast-paced world of entrepreneurship, one term has become synonymous with the fuel that propels startups towards success – Venture Capital (VC) funding. For innovative ventures looking to scale and expand rapidly, VC funding presents a golden opportunity to secure the necessary financial resources, mentorship, and industry connections. In this article, we will dive into the world of VC funding, exploring its significance, the process involved, and its impact on the startup ecosystem.

In this post, we'll cover:

- 1 What is Venture Capital (VC) Funding

- 2 The Significance of VC Funding

- 3 The VC Funding Process

- 4 How to Secure VC Funding for your Startup?

- 5 The Impact of VC Funding on the Startup Ecosystem

- 6 How does VC funding differ from other forms of funding?

- 7 Benefits of VC Funding

- 8 VC Funding Stages

- 9 VC Funding Criteria & Evaluation

- 10 VC Funding Pitch

- 10.1 Know Your Audience

- 10.2 Start with a Strong Hook

- 10.3 Clearly Define the Problem and Solution

- 10.4 Showcase Traction and Milestones

- 10.5 Present a Scalable Business Model

- 10.6 Address the Competitive Landscape

- 10.7 Showcase the Founding Team

- 10.8 Provide a Clear Ask and Use of Funds

- 10.9 Keep it Concise and Visual

- 10.10 Practice and Be Prepared for Questions

- 11 VC Funding Challenges

- 12 VC Funding Equity Terms

- 13 VC Funding Timeline

- 14 Disadvantages of VC Funding

- 15 Identifying the right VC firm

- 15.1 Define Your Startup’s Needs and Goals

- 15.2 Research VC Firms and Investors

- 15.3 Seek Referrals and Network

- 15.4 Evaluate the Investor’s Expertise and Support

- 15.5 Check for Cultural Fit

- 15.6 Assess the Investment Terms

- 15.7 Check the Investor’s Reputation and References

- 15.8 Consider Investor Geography and Network

- 15.9 Plan for Future Funding Rounds

- 16 What are some of the most active global VC funds?

- 17 TL;DR

What is Venture Capital (VC) Funding

Venture capital funding involves investments made by professional investors, known as venture capitalists, into early-stage startups and high-potential companies. Unlike traditional sources of funding like bank loans or personal savings, VC funding focuses on providing capital to companies with substantial growth potential but are often too risky for traditional lenders.

The Significance of VC Funding

VC funding offers several crucial advantages for both startups and investors:

- Access to Capital: Startups can access the much-needed financial resources to grow, expand their operations, develop new products, and hire talented teams.

- Expertise and Mentorship: Venture capitalists bring with them a wealth of industry experience and connections, guiding startups through critical decision-making processes and offering valuable mentorship.

- Accelerated Growth: With adequate funding, startups can scale their operations quickly and gain a competitive edge in the market.

- Risk Sharing: Venture capitalists understand the risks associated with early-stage ventures and are willing to share these risks in exchange for potential high returns.

The VC Funding Process

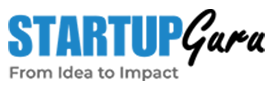

- Seed Stage: At the seed stage, startups are typically in their infancy, with a promising concept or prototype. Founders pitch their ideas to potential investors, seeking initial capital to turn their vision into a viable product.

- Early Stage: In this stage, startups have a functioning product or service with a small customer base. Venture capitalists invest larger sums to support the company’s growth and market expansion.

- Growth Stage: Startups at the growth stage have achieved significant traction and market validation. VC funds at this stage aim to scale the company to its full potential.

- Late Stage: At this stage, startups are nearing maturity, with a proven business model and a stable customer base. Late-stage VC funding focuses on boosting the company’s market dominance.

Here is a detailed article on how startup funding works if you are curious to learn more about this subject.

How to Secure VC Funding for your Startup?

Obtaining VC funding is a challenging process that requires thorough preparation and a compelling pitch. Here are some key steps to improve the chances of securing VC funding:

- Perfecting the Pitch: Startups must articulate their vision, product differentiation, target market, and revenue model clearly and concisely.

- Demonstrating Traction: Showing evidence of market validation, user growth, and revenue generation strengthens a startup’s case for investment.

- Assembling a Strong Team: Investors look for a cohesive and talented team with a diverse skill set, capable of executing the business plan effectively.

- Researching the Right Investors: Startups should approach VCs who have a history of investing in their industry or sector.

The Impact of VC Funding on the Startup Ecosystem

VC funding has a profound impact on the overall startup ecosystem:

- Innovation and Disruption: By supporting innovative ideas, VC funding drives technological advancements and disrupts traditional industries.

- Job Creation: Startups fueled by VC funding create job opportunities, contributing to economic growth.

- Competitive Landscape: As startups grow, they challenge established players, fostering a competitive and dynamic market environment.

- Attracting Talent: VC-funded startups attract top-tier talent, as prospective employees seek opportunities for growth and impact.

How does VC funding differ from other forms of funding?

Funding is the lifeblood of any business, especially for startups looking to scale and grow. While there are various sources of funding available, venture capital (VC) funding stands out as a unique and specialized form of investment that sets itself apart from traditional funding options. In this article, we will explore the key differences between VC funding and other forms of funding.

Equity Investment vs. Debt Financing

One of the primary distinctions between VC funding and other forms of funding lies in the financial structure. In VC funding, investors provide capital in exchange for equity ownership in the startup.

This means that the founders give up a certain percentage of their company to the investors. On the other hand, traditional forms of funding, such as bank loans or personal savings, involve debt financing, where the startup borrows money and agrees to repay it with interest over time.

Risk and Return

VC funding involves higher risk for investors compared to traditional lenders. Venture capitalists invest in early-stage startups and high-potential companies that are often considered too risky for banks or other conventional lenders.

As a result, VC investors seek higher returns on their investment to compensate for the elevated risk. Traditional funding, being more risk-averse, generally offers lower returns, but with less exposure to uncertainty.

Long-Term Vision

Venture capitalists often have a long-term vision for their investments. They are willing to wait patiently for the startup to grow and become successful over several years. This approach aligns the interests of both parties, as the VC firm’s success is tied to the startup’s success.

In contrast, traditional lenders typically expect regular loan repayments and are less concerned with the long-term growth and potential of the business.

Involvement and Mentorship

Venture capitalists not only bring financial resources but also offer valuable mentorship and industry expertise to the startups they invest in. They actively participate in shaping the company’s direction and offer guidance on strategic decisions.

On the other hand, traditional lenders are primarily concerned with repayment and may not be involved in the day-to-day operations of the business.

Funding Criteria

Venture capitalists evaluate startups based on their growth potential, innovation, market size, and scalability. They look for disruptive ideas and visionary founders.

Whereas, traditional lenders focus on the creditworthiness of the borrower, collateral, and the ability to repay the loan based on historical financial performance.

Accessibility

Obtaining VC funding can be more challenging than accessing traditional funding sources, especially for early-stage startups with unproven business models. VC investors conduct rigorous due diligence and select only a small percentage of startups that align with their investment thesis.

Traditional funding, such as bank loans, may be more accessible to a broader range of businesses, particularly those with established track records and collateral.

Overall, venture capital funding differs significantly from other forms of funding in its financial structure, risk-reward profile, long-term vision, and the level of involvement and mentorship provided.

While VC funding can be a powerful catalyst for growth, it may not be suitable for all startups due to its higher risk and selective nature.

Founders must carefully consider their business needs, growth potential, and the resources they require to determine the most appropriate funding option for their unique entrepreneurial journey.

Benefits of VC Funding

How can venture capital funding benefit my startup, beyond just providing financial resources?

Venture capital (VC) funding goes beyond the provision of financial resources, offering startups a plethora of benefits that can significantly impact their growth, sustainability, and success in the market. In this article, we will explore how VC funding can benefit startups in ways that extend well beyond monetary investment.

Strategic Guidance and Mentorship

Venture capitalists bring extensive experience and industry knowledge to the table. They often have a successful track record of working with startups and understanding the challenges they face.

As part of their investment, VCs provide invaluable strategic guidance and mentorship to the startup’s founders and management team. This hands-on involvement helps the startup navigate various obstacles, make informed decisions, and avoid common pitfalls.

Networking and Industry Connections

Access to a well-established network can be a game-changer for startups. Venture capital firms have vast networks of industry experts, potential customers, and other investors.

By connecting startups with the right people and companies, VCs can open doors to valuable partnerships, collaborations, and business opportunities that may not have been otherwise accessible.

Talent Acquisition and Team Building

Building a skilled and motivated team is crucial for a startup’s success. Venture capitalists often assist in talent acquisition by providing guidance on hiring practices, introducing founders to potential key hires, and advising on team-building strategies.

The network of VCs can attract top-tier talent to the startup, as potential employees are drawn to companies with reputable investors and growth potential.

Market Validation and Credibility

Securing VC funding is a strong signal of market validation. VCs invest in startups that show promise and have a viable business model. This validation boosts the startup’s credibility in the eyes of customers, partners, and other investors, making it easier to attract additional funding rounds and gain traction in the market.

Accelerated Growth and Scaling

With the financial backing and strategic guidance from VCs, startups can accelerate their growth trajectory. VC funding allows companies to invest in product development, marketing, and expanding their customer base at a faster pace. This competitive advantage can lead to market dominance and increased revenue generation.

Flexibility and Long-Term Vision

Unlike traditional lenders, VCs are generally patient investors with a long-term vision. They understand that startups require time to scale and reach their full potential. This flexibility in repayment timelines allows founders to focus on building their business without the immediate pressure of debt repayment.

Pivot and Course Correction

Startups often face the need to pivot or change their business model based on market feedback. VCs can be supportive during such transitions, understanding that adaptation is sometimes necessary for success. Their guidance and financial backing can provide startups with the confidence to make crucial course corrections without fear of losing support.

So, while financial resources are undoubtedly critical for startups, venture capital funding brings much more to the table.

The strategic guidance, mentorship, networking opportunities, and market validation offered by VCs can significantly benefit startups and enhance their chances of thriving in a competitive business landscape.

The combination of financial support and the expertise of venture capitalists makes VC funding a powerful catalyst for the long-term success of startups. Founders seeking not only capital but also a valuable growth partner should consider exploring the benefits that venture capital funding can offer to their entrepreneurial journey.

VC Funding Stages

What are the key stages of VC funding, and how does the investment process evolve as a startup grows?

Venture capital funding typically occurs in several distinct stages, each representing different levels of risk, maturity, and growth potential for the startup. The investment process evolves as the startup progresses through these different funding stages. In this article, we will explore the key stages of VC funding and how the investment process changes as a startup grows.

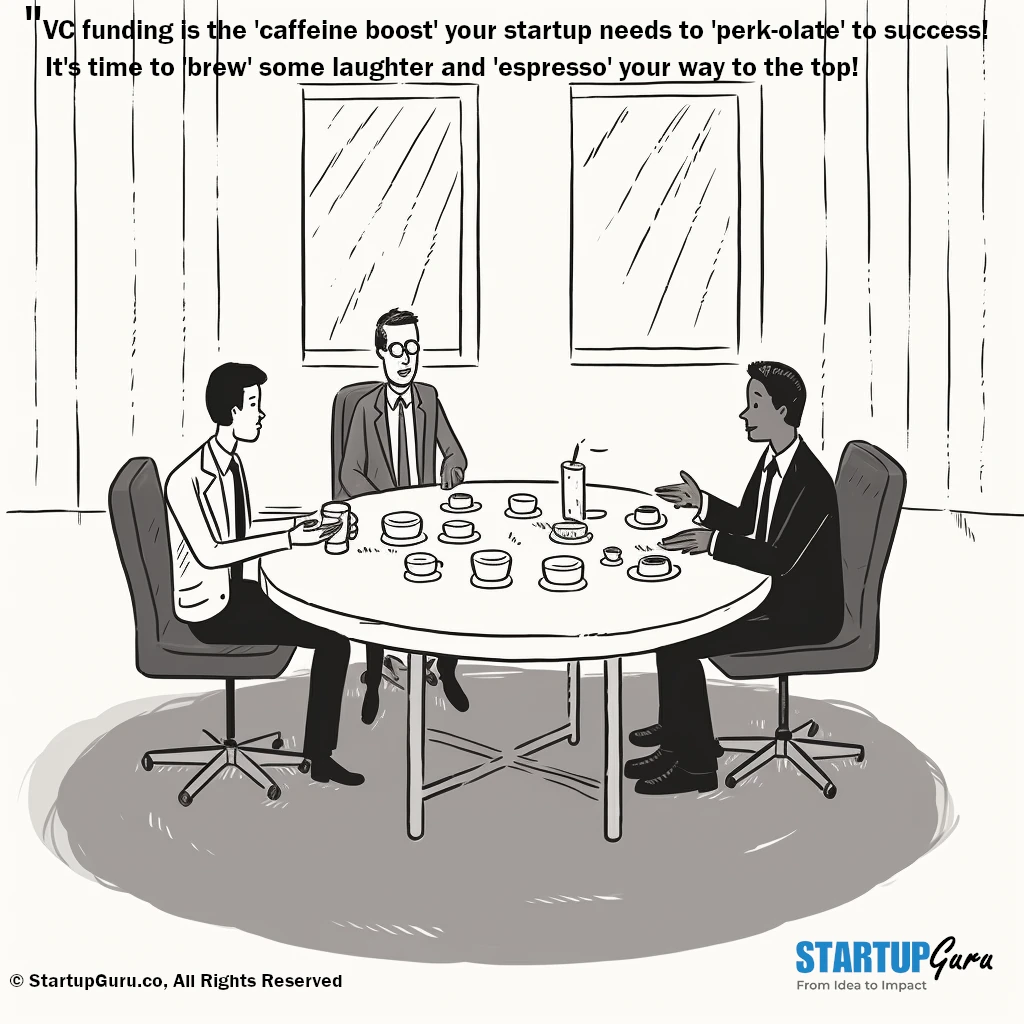

Seed Stage

There are some Seed VCs and for them, the seed stage is the initial phase of VC funding. Startups at this stage are usually in the early ideation or product development phase. They may have a minimum viable product (MVP) or a prototype but are yet to generate significant revenue. Seed funding is critical for conducting market research, refining the product, and building the founding team. Investors at this stage include angel investors, early-stage VC funds, and accelerator programs.

Investment Process

At the seed stage, investors primarily assess the startup’s vision, the market problem it aims to solve, and the capabilities of the founding team. Due diligence may be less extensive compared to later stages, as the startup is still in its infancy. Funding amounts are relatively smaller, and investors often take a more hands-on approach to support the startup’s early growth.

Early Stage

Startups in the early stage have progressed beyond the idea stage and have a working product or service. They have likely acquired some initial customers and may be generating modest revenue. Early-stage VC funding is crucial for scaling the business, expanding the customer base, and further developing the product.

Investment Process

At this stage, investors delve deeper into the startup’s market traction, user adoption, and potential for growth. They analyze key performance indicators (KPIs), unit economics, and competitive positioning. The funding rounds may involve more substantial investments, and startups may seek funding from venture capital firms that specialize in early-stage investments.

Growth Stage

The growth stage is characterized by significant market validation, a scalable business model, and substantial revenue growth. Startups at this stage have a proven track record and are looking to expand their operations, enter new markets, or diversify their product offerings. These are your typical Series A, B, C stages of startup funding.

Investment Process

Investors in the growth stage focus on the startup’s ability to capture a sizable market share, scale operations efficiently, and generate sustainable revenue growth. Due diligence becomes more comprehensive, involving detailed financial analysis, customer acquisition strategies, and competitive advantages. Growth-stage funding typically involves larger rounds led by established VC firms.

Late Stage

Startups at the late stage are close to achieving maturity. They have a well-established product, a significant customer base, and a clear path to profitability. These are typically Bridge Funding Rounds, Debt Financing, Mezzanine (hybrid of deb and equity financing) and IPO. Late-stage funding is often sought to support further expansion, potential acquisitions, or prepare for an initial public offering (IPO).

Investment Process

Late-stage investors closely scrutinize the startup’s financial performance, cash flow, and profitability. They assess the potential for exit opportunities, such as an IPO or acquisition. Late-stage funding rounds may include participation from private equity firms and other institutional investors.

As you can see, these key stages of VC funding – seed stage, early stage, growth stage, and late stage – mark the various phases of a startup’s growth journey.

As a startup progresses through these stages, the investment process becomes more detailed, strategic, and focused on market validation, scalability, and financial performance. Understanding these stages and the corresponding expectations of investors is crucial for startups seeking venture capital funding and planning their growth trajectory.

Successful navigation through these stages can lead to substantial financial backing, industry recognition, and the realization of a startup’s full potential in the market.

VC Funding Criteria & Evaluation

What criteria do venture capitalists typically use to evaluate startups for potential VC funding?

Venture capitalists (VCs) carefully assess numerous factors before deciding to invest in a startup. Their evaluation process is thorough and aims to identify startups with high growth potential, a compelling business model, and a strong likelihood of success. In this article, we will explore the key criteria that VCs typically use to evaluate startups for potential funding.

Market Opportunity

VCs look for startups operating in large and growing markets. A significant market opportunity indicates the potential for high revenue growth and a substantial return on investment. Startups targeting niche markets with limited growth potential may not align with a VC’s investment strategy.

Traction and Proof of Concept

Startups that have gained early traction and validated their product or service in the market stand a better chance of securing VC funding. Metrics like user adoption, customer feedback, revenue, and growth rate are critical indicators of a startup’s potential success.

Competitive Advantage

VCs assess a startup’s competitive advantage, which could be in the form of a unique technology, intellectual property, or a disruptive business model. A strong competitive advantage creates barriers to entry for competitors and strengthens the startup’s long-term prospects.

Founding Team

The startup’s founding team plays a pivotal role in attracting VC investment. VCs look for passionate, experienced, and capable founders with a deep understanding of the industry and market they are targeting. A strong founding team can instill confidence in investors regarding the startup’s ability to execute its business plan successfully.

Business Model and Revenue Potential

VCs analyze the startup’s business model to ensure it is scalable and sustainable. They assess the potential for revenue generation and the ability to achieve profitability over time. Startups with clear monetization strategies and diverse revenue streams are more attractive to VCs.

Growth Strategy

VCs are interested in startups with well-defined growth strategies. Startups should have a plan to expand their customer base, enter new markets, and outpace competitors. A compelling growth strategy demonstrates the startup’s vision and ambition for significant market penetration.

Exit Potential

VCs seek to generate returns on their investments through an eventual exit event, such as an initial public offering (IPO) or acquisition. VCs assess a startup’s potential for exit opportunities, which often involve evaluating the broader market landscape and potential acquirers or public investors.

Intellectual Property

Startups with valuable intellectual property, such as patents or trade secrets, can attract VCs’ interest. Intellectual property can provide a defensible advantage and enhance the startup’s market position.

Risk Assessment

VCs evaluate the risks associated with the startup, including market risks, competition, regulatory challenges, and operational risks. Startups with a clear understanding of these risks and a plan to mitigate them are more appealing to investors.

Venture capitalists employ a rigorous evaluation process when considering potential investments in startups.

By assessing market opportunity, traction, competitive advantage, founding team, business model, growth strategy, exit potential, intellectual property, and risk factors, VCs aim to identify startups with the highest potential for success and significant returns on their investments.

Founders seeking VC funding should be well-prepared to address these criteria and demonstrate how their startup aligns with the investor’s goals and vision.

VC Funding Pitch

How do I prepare an effective pitch to attract venture capital investors?

Preparing an effective pitch to attract venture capital investors requires careful planning, concise communication, and a compelling presentation of your startup’s value proposition.

VCs are approached by numerous startups seeking funding, so standing out from the crowd is crucial. In this article, we will outline key steps to help you craft an impactful pitch that captures the attention of venture capital investors.

Know Your Audience

Research the venture capital firm and the specific investors you will be pitching to. Understand their investment focus, previous portfolio companies, and their areas of expertise. Tailor your pitch to align with the interests and goals of the investors you are approaching.

Start with a Strong Hook

Begin your pitch with a powerful and engaging hook that grabs the investors’ attention from the start. This could be a compelling statistic, a thought-provoking question, or a succinct statement that highlights the problem your startup is solving.

Clearly Define the Problem and Solution

Articulate the problem your startup addresses and explain how your product or service provides a unique and effective solution. Focus on the pain points of the target market and demonstrate how your offering solves these challenges better than existing alternatives.

Showcase Traction and Milestones

Highlight any traction your startup has achieved so far. This includes user adoption, customer testimonials, revenue growth, partnerships, and any significant milestones. Demonstrating real-world validation can build confidence in your startup’s potential.

Present a Scalable Business Model

Explain your startup’s revenue model and showcase its scalability. Investors are interested in startups with the potential for exponential growth and a clear path to profitability. Be transparent about your unit economics and how you plan to expand the customer base.

Address the Competitive Landscape

Acknowledge the competition and provide a detailed analysis of how your startup differentiates itself from existing players. Showcase your competitive advantages and explain how they create barriers to entry for potential competitors.

Showcase the Founding Team

Introduce the founding team and their relevant experience, expertise, and passion for the project. Highlight any notable achievements or industry recognition that lends credibility to your team’s ability to execute the business plan.

Provide a Clear Ask and Use of Funds

Be specific about the amount of funding you are seeking and how you plan to utilize the capital. Clearly outline how the investment will be used to accelerate growth and achieve key milestones.

Keep it Concise and Visual

Keep your pitch concise and focused, typically within 15-20 slides. Use visuals, graphics, and data to support your points and make the presentation more engaging. Avoid overwhelming investors with excessive details.

Practice and Be Prepared for Questions

Practice your pitch thoroughly to ensure a confident and polished delivery. Anticipate potential questions from investors and be prepared to provide clear and concise answers.

Crafting an effective pitch to attract venture capital investors requires a deep understanding of your startup’s value proposition, target market, and growth potential.

A well-prepared pitch that addresses the problem-solution fit, traction, competitive landscape, and the founding team’s capabilities can make a strong impression on venture capital investors.

Remember to tailor your pitch to the interests of the specific investors you are approaching, and be prepared to adapt and refine your pitch based on feedback and interactions with potential investors. With a compelling and well-structured pitch, you can significantly increase your chances of securing the funding your startup needs to thrive.

VC Funding Challenges

What are some common challenges that founders face during the VC funding process, and how can they be overcome?

The VC funding process can be both exciting and challenging for startup founders. While securing venture capital can provide a significant boost to a startup’s growth, founders often encounter several hurdles along the way. In this article, we will explore some common challenges that founders face during the VC funding process and offer strategies to overcome them.

Finding the Right Investors

One of the initial challenges is identifying and connecting with the right venture capitalists who align with the startup’s industry, vision, and growth stage. Overcoming this challenge involves conducting thorough research to identify VC firms with a track record of investing in similar startups and leveraging networking events, industry conferences, and introductions to reach potential investors.

Standing Out in a Crowded Market

VCs review numerous startup pitches regularly, making it challenging for founders to stand out from the crowd. Founders can overcome this challenge by crafting a compelling pitch that clearly communicates the startup’s unique value proposition, traction, and potential for growth.

Captivating storytelling, data-backed evidence of market validation, and highlighting the team’s expertise can make the pitch more memorable.

During the due diligence process, VCs conduct a thorough examination of the startup’s financials, operations, legal matters, and more. Founders must be transparent and organized during this phase to build trust with investors. Having clean and up-to-date financial records, contracts, and legal documentation can streamline the due diligence process.

Negotiating Equity and Valuation

Deciding on the appropriate equity stake to offer to investors and agreeing on the startup’s valuation can be challenging. Founders should conduct research on industry standards, comparable startups, and recent funding rounds to arrive at a fair valuation. Being open to constructive negotiations and maintaining a cooperative attitude can facilitate a mutually beneficial agreement.

Managing Investor Expectations

After securing VC funding, founders face the challenge of meeting the expectations of their investors. This involves setting clear and achievable goals, maintaining open lines of communication with investors, and delivering on promises. Regular updates on progress, challenges, and opportunities can build trust and align expectations.

Balancing Growth and Control

As startups grow with VC funding, founders may face decisions about relinquishing some control to investors. Finding a balance between maintaining a significant stake in the company and benefiting from the expertise of seasoned investors is crucial. Founders should carefully evaluate the potential for strategic partnerships and the value that investors can bring to the company’s growth.

Preparing for Rejection

Not every pitch results in funding. Founders may encounter rejection from investors, which can be disheartening. Overcoming this challenge requires resilience and a willingness to learn from each pitch experience. Seeking feedback from investors who pass on the opportunity can provide valuable insights for refining the pitch and business strategy.

Needless to say, the VC funding process presents several challenges for startup founders, but with strategic planning, perseverance, and adaptability, these challenges can be overcome.

By researching and targeting the right investors, crafting a compelling pitch, maintaining transparency during due diligence, and managing investor relationships effectively, founders can enhance their chances of securing VC funding and propel their startups towards growth and success.

Founders should view these challenges as opportunities for learning and improvement, ultimately leading to a more robust and sustainable business.

VC Funding Equity Terms

What are the typical equity terms and conditions associated with VC funding, and how do they impact the ownership and control of the startup?

Venture capital funding involves a complex set of equity terms and conditions that shape the relationship between investors and startup founders. These terms are established in the term sheet, a non-binding agreement that outlines the key investment terms before finalizing the deal. In this article, we will explore the typical equity terms and conditions associated with VC funding and their impact on the ownership and control of the startup.

Valuation and Equity Stake

Valuation is the pre-money value of the startup before the investment. VCs determine the valuation based on various factors such as market potential, team, traction, and revenue. The equity stake represents the percentage of ownership the VC will have in the startup after the investment. The higher the valuation, the lower the equity stake offered to the VC, and vice versa.

Impact: A higher equity stake for the VC means a dilution of the founder’s ownership. Founders must strike a balance between securing sufficient funding and maintaining a significant share of their company.

Vesting Schedule

VCs often require founders and key employees to be subject to a vesting schedule for their equity. This means that the ownership of shares gradually “vests” over a specified period, typically four years, with a one-year cliff (a period before any shares vest). If a founder leaves the company before the vesting is complete, unvested shares are forfeited.

Impact: Vesting protects the interests of the VC by ensuring founders have a continued commitment to the startup’s success. It also encourages founders to stay with the company and aligns their interests with the long-term growth of the business.

Board Seats

VCs often secure the right to appoint one or more members to the startup’s board of directors. Board members play a crucial role in strategic decision-making, governance, and oversight of the company.

Impact: The VC’s board representation grants them significant influence over the startup’s major decisions. This can impact the direction of the company and might lead to changes in management or business strategies.

Liquidation Preference

Liquidation preference determines the order in which proceeds are distributed if the startup is sold or goes through a liquidity event, such as an acquisition or IPO. VCs typically negotiate for a preferred return on their investment before common shareholders receive any proceeds.

Impact: Liquidation preference can significantly impact the distribution of proceeds among stakeholders. In certain cases, it may result in the VC receiving a multiple of their initial investment before other shareholders receive anything.

Anti-Dilution Protection

VCs may negotiate for anti-dilution protection, which safeguards their investment from dilution in the event of a down-round (a subsequent funding round at a lower valuation). There are two types: full ratchet and weighted average anti-dilution.

Impact: Anti-dilution protection provides additional security to the VC, but it can lead to further dilution for common shareholders, including the founders, in a down-round scenario.

It is important to note that VC funding terms significantly impact the ownership, control, and financial outcomes of startups. Founders must carefully consider the terms outlined in the term sheet and their potential implications before entering into an agreement with venture capitalists.

Engaging legal and financial advisors during negotiations is crucial to ensure that the equity terms and conditions align with the startup’s growth objectives and the long-term interests of both founders and investors. By understanding these terms and their impact, founders can make informed decisions that set their startups on a path towards success and sustainable growth.

VC Funding Timeline

How long does it usually take to secure VC funding, and what are the timelines involved in the investment process?

Securing VC funding is a process that varies in duration depending on several factors, including the stage of the startup, the complexity of the deal, and the responsiveness of both the founders and the investors.

Generally, it may take anywhere from a few weeks to over a year to secure VC funding for your startup.

Psst! StartupGuru helps early stage founders raise their first capital within 16 weeks, through our incubation program. Click to find out how we do it.

The VC funding process can be divided into several key stages, each with its own timeline. In this article, we will explore the typical timelines involved in the investment process and factors that can affect the overall duration.

Initial Outreach and Introduction

The process often begins with founders reaching out to potential VC investors or being introduced through networking events or referrals. This initial stage can take anywhere from a few weeks to several months, depending on how quickly founders can connect with interested investors.

Preliminary Discussions and Due Diligence

Once a VC shows interest in the startup, preliminary discussions and due diligence begin. This phase involves evaluating the startup’s business model, market potential, team, and traction. The timeline for due diligence can vary but typically takes around 1 to 2 months.

Term Sheet Negotiation

If the due diligence is successful, the VC may present a term sheet, which outlines the key investment terms and conditions. Negotiating and finalizing the term sheet can take a few weeks to a month, depending on the complexity of the deal and the responsiveness of both parties.

Legal and Financial Documentation

After agreeing on the term sheet, the legal and financial documentation process commences. This involves drafting and reviewing legal agreements, investment documents, and any necessary regulatory filings. This phase can take around 1 to 2 months, depending on the complexity of the legal requirements.

Closing the Deal

The final step is closing the deal, where all parties sign the legal agreements, and the funds are transferred to the startup. This stage typically takes a few weeks to finalize.

Overall, the entire VC funding process, from the initial outreach to closing the deal, can take anywhere from 3 to 6 months, or even longer in some cases. Founders should be prepared for potential delays due to extensive due diligence, legal negotiations, or unforeseen circumstances.

Factors that can influence the timeline include:

Investor Interest: The level of interest from investors can impact how quickly they move through the due diligence and decision-making process.

Startup Stage: The stage of the startup can affect the complexity of due diligence and the level of information required, which may impact the overall duration.

Founder Preparedness: How well-prepared founders are with the necessary documentation and data can expedite the process.

Market Conditions: The state of the market and overall investor sentiment can influence the speed at which investors make decisions.

Legal and Regulatory Requirements: Complying with legal and regulatory requirements can introduce additional timelines to the process.

Securing VC funding is a significant milestone for startups, but the process requires time, effort, and patience. While the timeline can vary, founders can improve the efficiency of the investment process by being well-prepared, responsive, and engaged with potential investors.

Having a clear understanding of the typical stages and timelines involved in the VC funding process will help founders manage their expectations and plan accordingly for their startup’s growth journey.

Disadvantages of VC Funding

What are the risks and potential downsides of accepting VC funding for my startup?

Accepting VC funding can provide startups with valuable resources and support to accelerate growth. However, there are also risks and potential downsides that founders should carefully consider before entering into an agreement with venture capitalists. Let’s explore some of the risks and downsides associated with accepting VC funding for a startup.

Equity Dilution

When startups secure VC funding, they exchange a portion of their ownership (equity) for the investment. This can lead to significant equity dilution for founders and existing shareholders. As subsequent funding rounds occur, further dilution may occur, reducing the founders’ control over the company.

Loss of Control

Venture capitalists often require a seat on the board of directors and exert significant influence over strategic decisions. Founders may find themselves in situations where they have less control over the direction of the company and are required to align with investor interests.

High Expectations and Pressure to Perform

VC investors seek high returns on their investments and may have aggressive growth expectations. The pressure to meet these expectations can be intense for founders, leading to a focus on short-term gains over long-term sustainability.

Exit Pressure

VCs typically have a timeline for their investments, and they expect an exit event, such as an IPO or acquisition, within a certain period. This can create pressure for the startup to pursue an exit, even if it may not align with the founders’ long-term vision.

Decision-Making Conflict

Differences in opinions and decision-making between founders and VCs can arise, potentially leading to conflicts that may hinder the startup’s progress.

Loss of Flexibility

VC funding often comes with specific milestones and performance expectations. Startups may feel compelled to adhere to a predefined growth strategy, which could limit their ability to pivot or adapt to changing market conditions.

Public Scrutiny

Once funded by VCs, startups may face public scrutiny and increased expectations from customers, competitors, and stakeholders.

VCs are primarily focused on financial returns, which might not align with a startup’s social or environmental mission.

Failed Investment Rounds

Not all startups secure follow-on funding rounds. If a startup fails to meet milestones or demonstrate growth, they may face challenges in raising additional funds.

Accepting VC funding can be a strategic move to fuel rapid growth and expand a startup’s operations.

However, founders should carefully weigh the potential risks and downsides associated with VC funding against the benefits.

It is essential to have a clear understanding of the terms and conditions in the investment agreement and to ensure that the investor’s vision aligns with the long-term goals of the startup. Founders should also consider alternative funding options and assess whether VC funding is the right fit for their company’s growth strategy and vision.

By approaching VC funding with a well-informed and cautious mindset, founders can make informed decisions that set their startups on a path towards sustainable success.

Identifying the right VC firm

How can I identify the right venture capital firms or investors for my startup, and what factors should I consider before making a final decision on VC funding?

Identifying the right venture capital firms or investors for your startup is a critical step in securing funding that aligns with your business goals and values. The process involves research, networking, and careful evaluation to find the best fit for your startup’s needs. In this article, we will explore how to identify the right VC firms or investors and the key factors to consider before making a final decision on funding.

Define Your Startup’s Needs and Goals

Before seeking VC funding, clearly define your startup’s needs, growth objectives, and long-term vision. Understand the specific areas where funding can have the most significant impact on your startup’s growth. This will help you target investors who specialize in your industry and align with your strategic objectives.

Research VC Firms and Investors

Conduct extensive research on venture capital firms and individual investors to understand their investment focus, portfolio companies, investment stages, and track records. Look for investors who have experience in your industry or have successfully funded startups with similar characteristics to yours.

Seek Referrals and Network

Leverage your professional network to seek referrals and introductions to potential investors. Industry events, conferences, and startup communities are excellent platforms to connect with venture capitalists. Personal introductions can increase your chances of getting noticed and foster trust with investors.

Evaluate the Investor’s Expertise and Support

Assess the value-add that investors can bring beyond financial resources. Look for investors who can offer mentorship, industry expertise, strategic guidance, and networking opportunities to help your startup thrive. Consider the investor’s track record of actively supporting their portfolio companies.

Check for Cultural Fit

Cultural fit is crucial in the investor-founder relationship. Look for investors who share your values, understand your vision, and respect your autonomy as a founder. Aligning with investors who support your startup’s mission and culture can lead to a more productive and successful partnership.

Assess the Investment Terms

Carefully review the investment terms and conditions in the term sheet. Evaluate the valuation, equity stake, vesting schedule, board representation, liquidation preferences, and anti-dilution provisions. Ensure that the terms are fair and reasonable and that they align with your startup’s growth plans.

Check the Investor’s Reputation and References

Research the investor’s reputation in the industry and among their portfolio companies. Seek feedback from other founders who have received funding from the same investor. This will provide valuable insights into the investor’s level of involvement, responsiveness, and overall support.

Consider Investor Geography and Network

Consider the geographic location of the investor and their network of connections. An investor with a strong local presence can provide valuable access to regional markets, potential customers, and strategic partners.

Plan for Future Funding Rounds

Think beyond the current funding round. Consider how the investor’s involvement may impact future funding rounds and your startup’s ability to attract subsequent investments.

Identifying the right venture capital firms or investors for your startup requires thorough research, networking, and a clear understanding of your startup’s needs and long-term vision.

Take the time to assess potential investors’ expertise, cultural fit, investment terms, reputation, and network. Selecting the right investors can provide not only financial resources but also valuable support, guidance, and industry connections that can significantly enhance your startup’s chances of success. Carefully consider all factors before making a final decision on funding to ensure a mutually beneficial and productive partnership.

What are some of the most active global VC funds?

Here are 10 globally active venture capital firms/funds and brief information about them along with some of their key startup/company investments:

Sequoia Capital

One of the world’s most renowned VC firms, Sequoia Capital invests in technology, healthcare, and other high-growth sectors. They have a strong global presence.

Key Investments: Airbnb, Apple, Google, WhatsApp, Dropbox, LinkedIn, Stripe, Zoom, and many more.

Website

Accel (Accel Partners)

Accel is a prominent VC firm with a focus on early-stage and growth investments. They have a global portfolio and are active across various industries.

Key Investments: Facebook, Slack, Spotify, Atlassian, UiPath, Flipkart, Dropbox, and Qualtrics.

Website

Andreessen Horowitz (a16z)

A Silicon Valley-based VC firm known for its large fund sizes and strategic investments in technology startups.

Key Investments: Airbnb, GitHub, Lyft, Pinterest, Coinbase, Slack, Zoom, Robinhood, and Roblox.

Website

Kleiner Perkins

Kleiner Perkins is an established VC firm with a history of investing in innovative technology companies.

Key Investments: Amazon, Google, Twitter, Uber, Square, Snap, Peloton, and Beyond Meat.

Benchmark

Benchmark is a leading early-stage venture capital firm that focuses on technology startups.

Key Investments: eBay, Twitter, Snapchat, Dropbox, Uber, WeWork, and Grubhub.

Website

Bessemer Venture Partners

Bessemer Venture Partners is a well-established VC firm that invests in startups across various industries.

Key Investments: LinkedIn, Pinterest, Shopify, DocuSign, Twilio, Yelp, and ZoomInfo.

Website

Index Ventures

Index Ventures is a global VC firm investing in technology and life sciences companies.

Key Investments: Slack, Dropbox, Zendesk, Revolut, Robinhood, Farfetch, and Deliveroo.

Website

SoftBank Vision Fund

Operated by SoftBank Group, the Vision Fund is one of the largest VC funds globally, focused on technology investments.

Key Investments: Uber, WeWork, OYO, DoorDash, ByteDance (TikTok), and Arm Holdings.

Website

Founders Fund

Founders Fund is a venture capital firm co-founded by Peter Thiel, known for investing in disruptive technology startups.

Key Investments: SpaceX, Palantir Technologies, Airbnb, Spotify, Stripe, and Lyft.

Website

NEA (New Enterprise Associates)

NEA is one of the largest VC firms globally, investing in various sectors, including technology, healthcare, and energy.

Key Investments: Salesforce, Workday, Tableau, Coursera, Robinhood, and 23andMe.

Website

Please note that the investments listed are some of the notable ones, and these VC firms have numerous other investments in their portfolios. Additionally, their investment focus and portfolio may change over time as they continue to invest in promising startups.

TL;DR

Venture capital funding remains a potent force in the world of entrepreneurship, enabling startups to reach their full potential and driving economic growth. While securing VC funding is undoubtedly a challenging process, the rewards in terms of financial backing, mentorship, and growth opportunities are well worth the effort. With the right idea, a strong team, and a well-prepared pitch, startups can unlock the power of VC funding to propel themselves towards success in an ever-evolving business landscape.