Before investing in a startup, the main question investors ask is: how much is this startup worth? Deciding the valuation of a business before it has started and engendered revenue is, in reality, quite troublesome. Not at all like established business with incomes, resources and longer track records there is no settled upon guidelines for startups.

Valuation of a startup with little or no income is never straightforward and frequently one of the main purposes of conflict that must be consulted among investors and entrepreneurs. entrepreneurs need the incentive to be as high as it could be and investors need it sufficiently low with the goal that they possess a sensible part of the business for the money they contribute.

Startup valuation is a crucial aspect of the entrepreneurial journey, determining the worth of a startup and influencing funding decisions. However, valuing a startup can be complex and subjective. In this article, we will delve into the world of startup valuation, exploring key factors, methodologies, and challenges that entrepreneurs and investors encounter.

In this post, we'll cover:

Key Factors Influencing Startup Valuation

Several factors contribute to the valuation of a startup, including:

Market Potential

The size and growth potential of the target market significantly impact a startup’s valuation. Investors look for startups operating in large, high-growth markets with the potential to capture a significant share.

Unique Value Proposition

The strength and uniqueness of the startup’s value proposition play a crucial role. Factors such as product differentiation, competitive advantage, intellectual property, and scalability can enhance a startup’s valuation.

Growth Metrics

Investors assess a startup’s growth metrics, such as revenue growth rate, user base expansion, user engagement (weekly/monthly active users (WAU/MAU), customer acquisition cost (CAC), and customer lifetime value (LTV). Impressive growth numbers can positively influence valuation.

Team and Execution

The expertise, track record, and capabilities of the founding team are critical considerations. A strong and experienced team that demonstrates the ability to execute the business plan can drive higher valuations.

Startup Valuation Methods

Several methodologies are used to determine startup valuations. Some common approaches include:

Berkus Method

The Berkus Method is a simplified approach to startup valuation developed by Dave Berkus, an angel investor and entrepreneur. It focuses on assigning a pre-money valuation to startups based on key factors or milestones. While not as comprehensive as other valuation methods, the Berkus Method provides a straightforward framework for early-stage startups.

The key factors considered in the Berkus Method are as follows:

Sound Idea: Assigning a value to a startup begins with assessing the quality and viability of the business idea. A solid idea with market potential adds value to the startup.

Prototype: The development of a working prototype or proof of concept demonstrates progress and increases the startup’s value.

Management Team: The experience, expertise, and track record of the management team contribute to the valuation. A strong team with a successful background enhances the startup’s worth.

Strategic Relationships: Partnerships, agreements, or collaborations with strategic partners, customers, or suppliers can add value to the startup.

Product Rollout or Sales: Achieving early sales or successful product rollout demonstrates market demand and revenue potential, positively impacting the startup’s valuation.

For each factor, a specific value or milestone is assigned, typically ranging from $0 to $500,000. The assigned values are then added together to determine the pre-money valuation of the startup.

It’s important to note that the Berkus Method is a simplified approach and may not capture the full complexity of startup valuation. It is commonly used in early-stage funding rounds and serves as a starting point for negotiations between entrepreneurs and investors.

Entrepreneurs and investors should consider employing additional valuation methods and seeking professional advice to arrive at a more comprehensive and accurate valuation for startups.

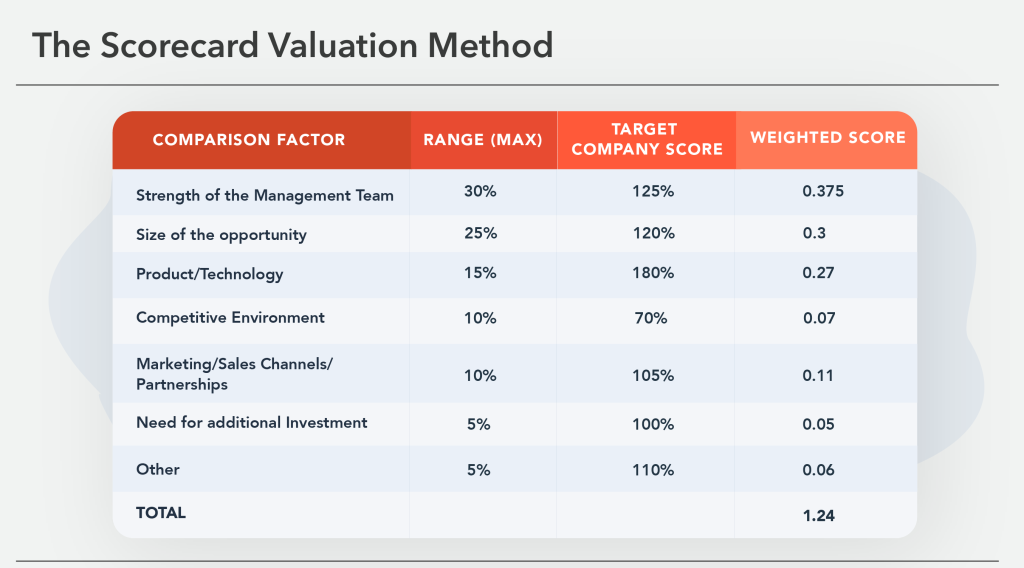

Scorecard Valuation Method

The Scorecard Valuation Method is an approach to startup valuation that takes into account various factors and compares the startup to other similar companies. It was developed by Bill Payne, an angel investor and educator, to provide a framework for early-stage startups.

The Scorecard Valuation Method involves the following steps:

Identify a Group of Comparable Companies: Start by selecting a group of similar startups in terms of industry, stage of development, geographic location, and other relevant factors. These comparable companies serve as benchmarks for valuation.

Define Key Factors: Determine a set of key factors that are important for startup valuation. These factors typically include the strength of the management team, market size and growth potential, competitive landscape, intellectual property, and product differentiation.

Assign Weight and Rating: Assign a weight to each key factor based on its relative importance. Then, rate the startup and each comparable company on each factor, typically using a scale of 0 to 5 or 0 to 10. The rating should reflect the startup’s performance or position compared to the comparable companies.

Calculate the Average Factor Rating: Calculate the average rating for each key factor across the comparable companies. This provides a reference point for evaluating the startup’s performance.

Adjust the Average Factor Rating: Compare the startup’s rating on each factor to the average rating from the comparable companies. Make adjustments based on whether the startup is performing better or worse than the average. Positive adjustments increase the valuation, while negative adjustments decrease it.

Determine Valuation: Multiply the average factor rating adjustment by the total valuation of the comparable companies. This provides an estimated valuation for the startup.

The Scorecard Valuation Method helps entrepreneurs and investors evaluate a startup’s potential by considering multiple factors and comparing it to similar companies. It provides a structured approach for assessing value and serves as a starting point for negotiations in early-stage funding rounds.

It’s important to note that the Scorecard Valuation Method is just one approach to startup valuation and should be used in conjunction with other methods and professional advice to arrive at a comprehensive and accurate valuation.

Comparable Company Analysis

This approach compares the startup to similar companies in the same industry, considering factors such as revenue, user base, and market share. Valuations of comparable companies serve as benchmarks.

Market Multiple

Investors prefer this approach, as it gives them an entirely decent sign of what the market is willing to for a business. Essentially, the market multiple approaches esteem the business against current acquisitions of comparable businesses in the market.

Cost-to-duplicate

As the name infers, this approach includes ascertaining the amount it would cost to construct another business simply like it without any preparation. The thought is that a brilliant investor wouldn’t pay more than it would cost to copy. This approach will frequently take a look at the physical assets for deciding their real esteem.

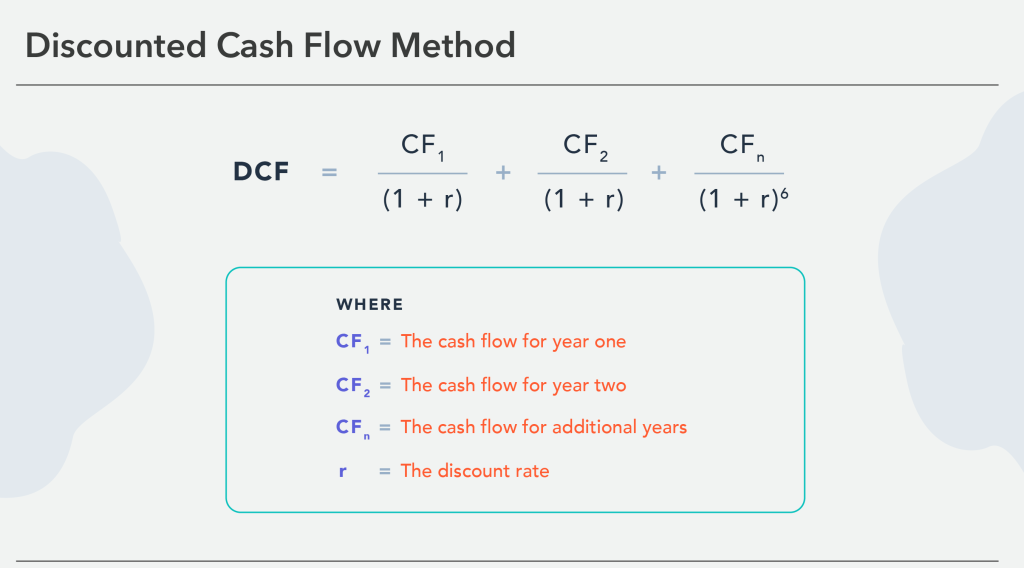

Discounted Cash Flow (DCF) Method

DCF analysis estimates the present value of a startup’s future cash flows. It involves forecasting future cash flows and applying a discount rate to account for the time value of money.

For most startups – especially those that have not yet started generating income – the bulk of the value rests on future potential. This approach is an important valuation approach. DCF involves forecasting how much cash flow, the business is going to engender in the future, and then, using an expected rate of investment return, the calculation is made on how much that cash flow is worth. A higher discount rate is typically applied to startups, as there is a higher hazard that the company will inescapably fail to engender viable flows of money.

Venture Capital Method

The venture capital method involves estimating the potential return on investment (ROI) for investors based on future funding rounds and exit scenarios. It considers factors like projected revenue and expected exit multiples. As the name suggests, this method is preferred by venture capital firms while evaluating early stage startups.

Challenges in Startup Valuation

Valuing startups can be challenging due to various factors, including:

a. Limited Financial History: Startups often lack a substantial financial history, making it difficult to project future financial performance accurately.

b. Uncertainty and Risk: Startups operate in an environment of uncertainty, with a high risk of failure. Investors must carefully evaluate the risk-reward ratio when assigning valuations.

c. Subjectivity and Investor Perception: Valuation is subjective and influenced by investor perceptions, market trends, and investor appetite for certain industries or technologies.

Conclusion:

Startup valuation is a dynamic and intricate process that involves assessing multiple factors and employing various methodologies. Entrepreneurs and investors must navigate the complexities of startup valuation to determine a fair and reasonable value for the business. By considering key factors, using appropriate valuation methodologies, and maintaining a realistic perspective, entrepreneurs can position themselves for successful fundraising and investors can make informed investment decisions. Understanding the intricacies of startup valuation empowers stakeholders to navigate the funding landscape with confidence and maximize the potential of their ventures.

thanks for sharing this article us with us. it is very useful

keep up the good work.