Venture Advisory for Early-Stage Companies

We accelerate & invest in growth companies

StartupGuru Venture Advisory is an industry leading support channel for early stage growth companies. With our support ecosystem, you will be able to take your company to the next level of growth by identifying and meeting the required KPIs and eventually raise the necessary capital.

JOIN 500+ STARTUPS & COUNTINGOUR STARTUPS HAVE BEEN FEATURED IN

Over $1 billion in lifetime valuation of portfolio companies

OYO Rooms

$10 billion+ in valuation,one of our earliest portfolio startups

Fractal Analytics

$1 billion in valuation

Dized, Playmore Games

€5+ million in valuation

StepOut.fi

€1 million in funding

GEMS Education, UAE

Indiabulls Ltd

Kranzle GmbH

Solvay AB

Average Seed Funding

Recent Fundraising

Startups Supported

Faster Time-to-Market

Global network with investors & startup ecosystem players

Reject the Amateur Coaches - Learn from the Gurus who've been there, done that!

Learn from the masters themselves! StartupGuru is all about practical, actionable and to-the-point know-how and you can’t learn this just by reading some articles, books or watching videos from someone who has never experienced starting a products company or investing.

Last thing you want to get into, as a budding entrepreneur, is to learn how to startup from someone who is selling you a book or a course on starting up and that’s the only startup experience s/he has! Duh! o-). Learn more

We have brought in industry leaders who have either started successful companies themselves, raised funding or are investors who are actively involved into startup investments across different sectors and regions.

These industry veterans have built companies with million dollar plus revenues, have raised millions in funding or are actively investing into startups.

Learn the nuances of starting up quickly in 2026 with MSP product launch, traction and early funding from the ecosystem players themselves. StartupGuru arranges regular guest sessions from these gurus as part of this program.

WE’RE NOT FOR EVERYONE

StartupGuru Venture Advisory is for you if...

You are confused about the vision

You have a great product and have managed to build and run it thus far, but now you feel lost about the next steps. You feel clueless or confused about the alignment between your current situation and your vision for the company. You feel the growth is stagnated.

You’re ready to commit and focus

We may not be the right choice for you if you are thinking that we will do all the heavy lifting for you. We will have our proven guidance, but you will lead from the front.

You want experts on board

You know that building your startup on your own is hard. You understand that you want an expert team on board who come in with years of enterprising, entrepreneurship and fundraising experience.

FIND YOUR FIT

Incubator

Incubator - for Idea stage startups (Pre-Seed)

Go for our startup incubator cum accelerator program if you are at the idea, concept or prototype stage. If you are non-technical, first time founder. You haven't raised external capital before for this startup in particular.

Venture Advisory

Venture Advisory - for growth companies/scale ups (Seed, Pre Series A)

Go for venture advisory if you have built your product/MVP and have some traction. Or if you are a non-digital company, you already have some revenues, users/customers. You may or may not have raised external capital for this startup, but DON'T have any VC or PE on board already. Also, you should NOT have more than 5 external investors on board.

HOW IT WORKS

Our Unique 4 Stage Program will take your company to the next level of growth & funding

For the last 16 years we've been helping companies go from ideas to launch and getting funded. We understand what benchmarks are required given the kind of capital you want to raise. What KPIs are required and what should be your blue ocean strategy. We've perfected our process and system through boots on the ground work, with the help of global investors and experts.

Bechmark your metrics against the best-in-class.

Know your Key Performance Indicators (KPIs) required to be able to raise the capital that you need for your next level of growth.

If you are bootstrapped or have FFF (friends & family) funding into your company, there is a possibility that you either don't know your KPIs or have the wrong parameters and data. Anyone who tells you that you don't need this is lying. Investors evaluate your company's worth primarily through this mechanism - benchmarking.

Now, you are probably early stage, so comparing you with the best in the industry, or with your #1 competitor would be meaningless. And often you get clueless as to then what is the right method.

Approaching investors without the right KPIs would get you no calls and results.

You will have to dig deep into your data, if at all you have sufficient data and traction, and come up with the right metrics and numbers.

If you don't have sufficient data, again this can be a chicken and egg problem. And quite often, this is a time consuming task.

And before you figure it out on your own, you've likely spent tens of thousands of your own money with little to show.

We benchmark you against your own vision while still considering your industry or sector's average. What metrics are necessary for you given your company's stage and its business model.

It can be as simple as learning the right DAUs, MAUs (Monthly Active Users), MRR/ARR (Monthly/Annual Recurring Revenue), User Retention/Return Ratio, CAC v/s LTV to some advanced KPIs such as knowing the user stickiness, user footprint across your sections/pages/verticals, channelizing your funnel with KPIs etc.

Because we work on all but only the necessary KPIs that investors are interested in, given your business model and sector, you will know exactly where you stand comparing with where you should be, considering the asking capital needs.

Where you are and where you should be, before you can fundraise.

Knowing your KPIs with the right values is one thing, interpreting them while benchmarking them against your vision is another. Our team knows what exactly the investors are looking for and what numbers are required that would give them confidence.

Most founders often get this wrong. They interpret the KPIs in a way that is not understood by most investors today, or that is not the way to interpret for their industry.

If they get it right somehow, they benchmark it against the wrong subjects/peers and hence get the wrong gap analysis.

This can be disastrous as the results can then lead the founders to then spend their valuable time and money filling the gaps that were irrelevant for their growth and fundraising.

Once our team collects the benchmarking data and understands the KPIs, we analyze and interpret them to understand the gaps between the current performance and the benchmarked targets.

The gaps can be in terms of a product or feature that is over-built or is poorly built. In some cases, we can also identify missing opportunities that are in demand but not yet built.

The gaps can be in terms of wrong/improper problem-solution-fit and product-market-fit, poor customer/user engagement, weak channel utilization, poor market penetration, wrong customer segment, misinterpration of ideal v/s target users, among others.

Now you will know exactly what has been at the root cause of your stagnated growth. What needs to be fixed before you are ready for your fundraising.

This discovery is the key to your success through the next stages.

Planning & goal setting for the fundraise.

Most founders run their startup traditionally with very little room for error, with any slip up totally derailing their launch or killing their runway. Our approach maximizes easy to implement strategies and targets hyper specific growth targets to attract your ideal investors.

There are a million strategies founders could implement, which traditionally has caused analysis paralysis. Growth is stagnated due to multiple reasons - not having enough users, irrelevant KPIs, unrealistic goals, lack of funding to support the desired growth, wrong marketing strategies and implementation, wrong sales funnel, wrong founder-problem-fit and the list keeps growing. With so much to focus on, a founder doesn't really know which method will be the most cost efficient and will drive results.

GTM experts naturally will emphasize on what they are selling and this further creates a decision trauma.

This left founders trying a million things, desperately searching for people to use their app, struggling to maximize revenue, achieve milestones - all of this without any proper goal setting. And who knows it in the first place? Who/what do they trust?

Additionally, founders also aren’t sure what benchmarks to hit to even know what 'success' looked like. Do they need $5K in revenue to impress an investor, or $50K? 1K users or 100K? 20% MoM growth or 15%? Wrong KPIs, wrong goal alignment = struggle.

Founders are left praying, wishing, and hoping that they are implementing the right goals and strategies to grow their startup, as well as doing their best to gain some semblance of success, even though they really didn't know what 'success' was measured by.

This led founders to go weeks, months, or years going after user growth, lost in a sea of 'shiny new tactics' because there was no end goal in sight.

We decided to take a 'top-down' approach to defining what success looks like for a startup's journey from one to ten.

We went and spoke with hundreds of investors to determine what numbers a startup needed to hit to gain their attention and their funding.

This led to the SMART goal setting, which is unique for every startup. Based on the benchmarking results, the company can establish specific, measurable, attainable, relevant, and time-bound (SMART) goals for improvement. Achieving these goals (aligned with the target KPIs) would allow them to go into investor meetings with confidence knowing they hit the numbers an early stage investor needed to consider funding them.

Our founders are able to utilize data-drive strategies with the help of our growth team, along with specific goals for user growth.

They now have a better understanding of the user footprint and the kind of stickiness their solution/platform has.

Instead of going into the SMART Goal phase not knowing what success looks like, they have exact numbers and specific tactics they can aim for, with the confidence to know that as soon as they hit those numbers that investors will be clamoring for their attention, instead of the other way around.

Raise funding on your own terms.

Once we've helped you achieve your SMART Goals, you'll need funding to scale up quickly and efficiently. Our funding team will help you raise $200K to $1M to do just that.

Raising funding is hard, and most founders aren't able to do it. Traditionally founders would rely on unrealistic advice like…

- Raising seed money from FFF (friends, family or fools)

- Sign up for all the shiny and costly pitch competition

- Most competitions are overly competitive (even AirBNB lost tons of pitches)

- Participate in startup events all across the globe to network and connect with strangers you wouldn’t like otherwise

- Approach random strange investors on LinkedIn and end up getting demotivated after no response.

- Get a loan or line of credit

- Banks don't lend to new businesses. Period.

This unrealistic approach doesn't work anymore. That's why only less than 2% of all startups raise funding, and the ones who do it takes over 12 months to get it! 12 months is a lifetime for most startups in their early stage – how do you know you will even survive until that time!? By then most startups die in their infancy.

At it's core, raising funding is just a sales and marketing process. The only difference between it and selling a $10/month subscription or a $1K product is that you're trying to sell someone on giving you a $25K+ check. That's it.

BUT most entrepreneurs don't know how to do high ticket sales. Prospecting, targeting, cold email and LinkedIn outreach. Touch points, what to say, how to say it, how to negotiate, how to structure an offer, etc. is something most founders don’t have a clue about.

That's what we do for the founders we work with. Once you start treating your fundraising stage like a sales and marketing issue, it all comes down to a numbers game.

And we being a player on both sides of the table (founders as well as being investors ourselves in over a dozen companies), we know how these cards are played.

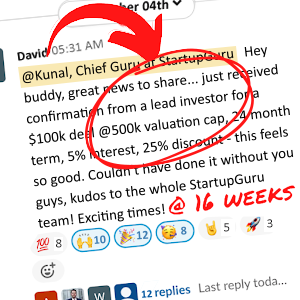

Our founders are able to consistently book investor meetings through our network as well as by utilizing the outbound sales and marketing techniques we teach and help them implement. Then raising funding becomes a numbers game.

This combined with some select investor meetings from our network guarantees you achieve your fundraising goal in the shortest time possible at this stage.

- 100 targeted investors

- 20 responses

- 5 meetings booked

- 2 term sheets

- $100K in funding

Need to raise more? Just rinse and repeat.

THE OUTCOME

This all results in your validated, scalable & funded startup.

A proven, validated startup

We help ensure you're expanding your effort, energy, and resources into an idea that has the highest chance of success in your market by using data driven principles.

Know where you are

Our research team works with you to understand what KPIs are measured for your sector, what numbers are required for your fundraising target, and find out where you are compared to that.

Accelerate growth

Using the SMART Goals methodology, our GTM team guides you through the process of user acquisition, channel creation, user engagement etc. to achieve the required target for an accelerated growth.

$200K to $1M in seed funding

Our startups know exactly where and how to secure funding, and get the help of our funding team to get follow-on funding from investors with a goal of a $200K to $1M seed round.

Our program is designed for YOU

Handholding

Most of the activities that we talk about are researched, implemented and managed by our team alongside the founders. We act as your partners, and not just as an advisor.

One-on-one support

This isn't some group accelerator or incubator where you're just a logo or number. You'll actively work alongside our team to get things done with step-by-step actionable program and guidance.

Active community

Our entrepreneurs help and support each other in our active community, weekly (virtual) meetups, and group pitch events.

Demo Day & Investor Networking

Specially designed demo day with targeted investors for startups in our program. We have investors lined up to work with the startups who go through our program because they know what we do works.

Our founders also get over $100K+ in discounts from our amazing partners

Clerky

$5000 discount

Stripe

NO FEES ON $20K

Brex

80K POINTS

AWS

$5000 CREDITS

Hubspot

90% DISCOUNT

Zendesk

6 MONTHS FREE

Vouch

25% OFF

Dialpad

10 FREE LINES

Ripling

6 MONTHS FREE

Gust

25% DISCOUNT

Google Cloud

$5000 CREDITS