In this post, we'll cover:

- 1 Best Venture Capital Firms for Tech Startups

- 2 List of the Top Global Venture Capital Firms

- 2.1 Sequoia Capital

- 2.2 Tiger Global Management

- 2.3 Accel

- 2.4 Andreessen Horowitz (a16z)

- 2.5 Kleiner Perkins (KPCB)

- 2.6 Benchmark

- 2.7 Bessemer Venture Partners

- 2.8 Index Ventures

- 2.9 SoftBank Vision Fund

- 2.10 GGV Capital

- 2.11 Founders Fund

- 2.12 NEA (New Enterprise Associates)

- 2.13 Lightspeed Venture Partners

- 2.14 Greylock Partners

- 2.15 DST Global

- 2.16 General Catalyst

- 2.17 500 Startups (500 Global)

- 2.18 Insight Partners

- 2.19 Northzone

- 2.20 Institutional Venture Partners (IVP)

- 2.21 Khosla Ventures

- 2.22 Dragoneer Investment Group

- 2.23 Draper Fisher Jurvetson Management (DFJ)

- 2.24 Greylock Partners

- 2.25 IDG Capital

- 2.26 Tencent Group

- 2.27 Naspers

- 3 Top Venture Capital Firms in the Global Unicorn Club

Best Venture Capital Firms for Tech Startups

Venture capital firms are crucial players in the dynamic world of startups and innovative ventures. As the engine of economic growth and technological advancement, these firms provide the financial backing and strategic guidance that entrepreneurs need to turn their ideas into reality.

Some venture capital (VC) firms, however, go beyond borders and geographical limitations, actively seeking investment opportunities on a global scale. In this article, we will explore the top venture capital firms that have transcended national boundaries and made a significant impact in the global startup ecosystem.

List of the Top Global Venture Capital Firms

Here are 10 globally active venture capital firms and funds that are globally active. These are some of the best venture capital firms with proven track record of successful startups that they have funded and backed.

These venture capital firms have established themselves as major players in the global startup ecosystem, with a track record of successful investments that have transformed industries and redefined how we live, work, and interact with technology. Their continued support and funding of innovative startups promise to shape the future of entrepreneurship and technology on a global scale.

Please note that the investments listed are some of the notable ones, and these top VC firms have numerous other investments in their portfolios. Additionally, their investment focus and portfolio may change over time as they continue to invest in promising startups. This list is not in any particular order.

You may also like: Top 60 Venture Capital Firms in the USA

So, let’s check out who are the most active venture capital (VC) firms in the world in 2024.

Sequoia Capital

One of the world’s most renowned VC firms, Sequoia Capital invests in technology, healthcare, and other high-growth sectors. They have a strong global presence.

Sequoia Capital has a storied history of successful investments across multiple continents. With offices in Silicon Valley, China, India, and Israel, Sequoia has strategically positioned itself to identify and nurture promising startups worldwide. The firm has invested in numerous tech giants, including Apple, Google, and WhatsApp, and its global footprint ensures a diverse portfolio that spans across industries and geographies.

Headquarters: Menlo Park, California, United States

Active Investments in: United States, China, India, Israel

Key Investments: Airbnb, Apple, Google, WhatsApp, Dropbox, LinkedIn, Stripe, Zoom, and many more.

Number of Investments: Over 1,500

Assets Under Management (AUM): Approximately $28 billion

Tiger Global Management

Tiger Global Management is a leading global investment firm known for its aggressive investment strategies. The firm has a stellar track record of backing high-growth companies across the globe. Some of its key investments include Stripe, the online payment processing platform; Coinbase, a prominent cryptocurrency exchange; ByteDance, the parent company of TikTok; UiPath, a leading robotic process automation company; and Flipkart, one of India’s largest e-commerce platforms.

Headquarters: New York City, New York, United States

Active Investments in: Global

Key Investments: Stripe, Coinbase, ByteDance (TikTok), UiPath, Flipkart

AUM: Approximately $65 billion

Accel

Accel is a prominent VC firm with a focus on early-stage and growth investments. They have a global portfolio and are active across various industries.

Accel Partners has carved a niche for itself as a globally active VC firm with investments in various high-growth sectors. With a strong focus on early-stage companies, Accel has played a crucial role in nurturing startups from their inception to becoming global players. The firm’s cross-border expertise extends to Europe, India, China, and Israel, among other regions, making it a well-established name in the international VC landscape.

Headquarters: Palo Alto, California, United States

Active Investments in: United States, Europe, India, China

Key Investments: Facebook, Slack, Spotify, Atlassian, UiPath, Flipkart, Dropbox, and Qualtrics.

Number of Investments: Over 1,300

AUM: Approximately $12 billion

Andreessen Horowitz (a16z)

Andreessen Horowitz, now known as a16z, A Silicon Valley-based VC firm known for its large fund sizes and strategic investments in technology startups.

Famous for its “software is eating the world” mantra, Andreessen Horowitz (a16z) is a venture capital firm that has made waves globally. Known for its involvement in cutting-edge technologies such as blockchain and artificial intelligence, a16z seeks out disruptive startups regardless of their location. Its extensive network of industry experts and thought leaders allows it to provide unparalleled mentorship and guidance to its portfolio companies, nurturing their growth on a global scale.

Headquarters: Menlo Park, California, United States

Active Investments in: United States

Key Investments: Airbnb, GitHub, Lyft, Pinterest, Coinbase, Slack, Zoom, Robinhood, and Roblox.

Number of Investments: Over 550

AUM: Approximately $35 billion

Kleiner Perkins (KPCB)

Kleiner Perkins, founded in 1972, is one of the oldest and renowned venture capital firm with a rich history of backing some of the most influential technology companies in the world. With a strong presence in Silicon Valley, Kleiner Perkins has been at the forefront of driving innovation and supporting entrepreneurs in their quest to disrupt industries.

Over the years, the firm has invested in numerous successful startups, including Amazon, Google, and Genentech, cementing its position as a key player in the tech industry.

KPCB’s portfolio spans across industries, including technology, healthcare, and consumer goods.

Kleiner Perkins (KPCB) continues to seek out visionary founders and groundbreaking ideas, providing them with the necessary resources and expertise to scale and thrive in the global market. Its diverse portfolio and hands-on approach make it a sought-after partner for ambitious entrepreneurs looking to leave a lasting impact on the world.

Headquarters: Menlo Park, California, United States

Active Investments in: United States, Europe, China, India, Israel, and other regions globally

Key Investments: Amazon, Google, Twitter, Uber, Square, Snap, Spotify, Peloton, and Beyond Meat.

Number of Investments: Over 900

AUM: Approximately $7 billion

Benchmark

Benchmark is a global VC firm that has made a significant impact on the technology landscape. Known for its early-stage investments in companies like Uber, Twitter, and Snapchat, Benchmark has shown an ability to spot game-changing opportunities worldwide. With a focus on software and technology-driven ventures, the firm maintains a diverse portfolio that spans continents, fostering innovation across the globe.

Headquarters: San Francisco, California, United States

Active Investments in: United States, Europe

Key Investments: eBay, Twitter, Snapchat, Dropbox, Uber, WeWork, and Grubhub.

Number of Investments: Over 250

AUM: Approximately $5 billion

Bessemer Venture Partners

Bessemer Venture Partners is one of the oldest and most respected venture capital firms globally. With a focus on technology startups, the firm has been instrumental in nurturing innovative companies.

Key investments by Bessemer Venture Partners include LinkedIn, the professional networking platform; Pinterest, the image-sharing and social media platform; Skype, the communication software company; Twitch, the live streaming platform for gamers; and Twilio, the cloud communications platform.

Headquarters: Menlo Park, California, United States, and New York City, New York, United States

Active Investments in: United States, Israel, Europe, India, China

Key Investments: LinkedIn, Pinterest, Shopify, Skype, DocuSign, Twilio, Twitch, Yelp, and ZoomInfo.

Number of Investments: Over 1,300

AUM: Approximately $5 billion

Index Ventures

With a strong presence in both Europe and the United States, Index Ventures is a venture capital firm that focuses on supporting innovative startups in technology and life science. The firm has played a pivotal role in nurturing startups that have gone on to become global success stories.

Key investments by Index Ventures include Deliveroo, a food delivery service; Revolut, a digital banking and financial services platform; Dropbox, a popular cloud storage and collaboration tool; Robinhood, a commission-free stock trading platform; and Slack, a widely-used team collaboration tool.

Headquarters: San Francisco, California, United States, and London, United Kingdom

Active Investments in: United States, Europe, China, Israel

Key Investments: Slack, Dropbox, Zendesk, Revolut, Robinhood, Farfetch, and Deliveroo.

Number of Investments: Over 500

AUM: Approximately $7 billion

SoftBank Vision Fund

Operated by SoftBank Group (the Japanese multinational investment holding company), the Vision Fund is one of the largest VC funds globally, focused on technology investments.

SoftBank’s Vision Fund shook the global VC landscape with its record-breaking size and bold investments in high-profile companies. With a focus on transformative technologies like robotics, artificial intelligence, and renewable energy, the Vision Fund seeks out potential unicorns worldwide. Although it faced challenges with some investments, the fund’s global reach and ambitious vision remain noteworthy.

Headquarters: Tokyo, Japan

Active Investments in: Global

Key Investments: Uber, WeWork, OYO, DoorDash, ByteDance (TikTok), and Arm Holdings.

AUM: Approximately $100 billion

GGV Capital

GGV Capital is a global venture capital firm with a focus on early-stage investments in both the United States and China. The firm’s investments have supported startups that have achieved substantial growth and success. Notable investments by GGV Capital include Didi Chuxing, a major ride-hailing platform in China; Alibaba, the e-commerce giant; Slack, the team collaboration software; Airbnb, the global lodging marketplace; and Xiaomi, a leading Chinese electronics company known for its smartphones and smart devices.

Headquarters: Menlo Park, California, United States, and Shanghai, China

Active Investments in: United States, China

Key Investments: Didi Chuxing, Alibaba, Slack, Airbnb, Xiaomi

AUM: Approximately $6.2 billion

Founders Fund

Founded by a group of visionary entrepreneurs including Peter Thiel, Founders Fund is a venture capital firm that seeks out groundbreaking companies and disruptive technology startups.

The firm’s bold investments have included SpaceX, the private aerospace manufacturer and space transportation company; Palantir Technologies, the data analytics and surveillance software company; Airbnb, the global lodging marketplace; Spotify, the music streaming service; and DoorDash, a leading food delivery platform.

Headquarters: San Francisco, California, United States

Active Investments in: United States

Key Investments: SpaceX, Palantir Technologies, Airbnb, Spotify, Stripe, DoorDash and Lyft.

NEA (New Enterprise Associates)

New Enterprise Associates (NEA) is one of the largest and most respected venture capital firms in the world, with a rich history of supporting groundbreaking startups. Headquartered in Menlo Park, California, NEA has been a key player in Silicon Valley and the global startup ecosystem since its founding in 1977.

NEA has a wide-ranging investment strategy that spans various industries, including technology, healthcare, and energy. The firm’s global reach extends beyond the United States, with active investments in startups across different countries and regions, making it a prominent player in the international venture capital landscape. NEA’s diverse portfolio and experienced team have contributed to the success of numerous startups, propelling them to become industry leaders and driving innovation on a global scale.

Headquarters: Menlo Park, California, United States

Active Investments in: United States, Europe (UK, Germany, France), China, India

Key Investments: Salesforce, Workday, Tableau, Coursera, Robinhood, and 23andMe.

AUM: Approx. $18 billion

Lightspeed Venture Partners

Lightspeed Venture Partners is a global VC firm with investments spanning Asia, Europe, and the Americas. The firm’s portfolio includes notable startups like Snapchat and Affirm, highlighting its ability to identify and support game-changing ideas across borders. Lightspeed‘s sector-agnostic approach and diverse expertise enable it to invest in startups from various industries and geographies.

Headquarters: Menlo Park, California, United States

Active Investments in: United States, Europe, China, India, Israel

Key Investments: Snap Inc. (Snapchat), Affirm, Nutanix, OYO Rooms, Stitch, AppDynamics, MuleSoft

AUM: Approx. $8 billion

Greylock Partners

Greylock Partners is a prestigious venture capital firm that has been actively investing in transformative technology companies since its inception. The firm’s extensive experience and network have allowed it to identify and support industry-disrupting startups.

Notable investments by Greylock Partners include LinkedIn, the professional networking platform; Airbnb, the global lodging marketplace; Facebook, the social media giant; Dropbox, the cloud-based file storage service; and Spotify, the popular music streaming service.

Headquarters: Menlo Park, California, United States

Active Investments in: United States, Europe

Key Investments: LinkedIn, Airbnb, Facebook, Dropbox, Spotify

DST Global

DST Global is a global investment firm that has made significant investments in some of the world’s most valuable technology companies. The firm’s strategic approach and global outlook have led to key investments in Facebook, the social media behemoth; Alibaba, the e-commerce giant; Twitter, the microblogging platform; Spotify, the music streaming service; and Xiaomi, a leading Chinese electronics company known for its smartphones and smart devices.

Headquarters: Hong Kong

Active Investments in: Global

Key Investments: Facebook, Alibaba, Twitter, Spotify, Xiaomi

General Catalyst

General Catalyst is a venture capital firm that is actively involved in nurturing startups from early stages to maturity. The firm’s diverse portfolio spans various industries, including technology, healthcare, and consumer goods.

Some of its key investments include Snap, the multimedia messaging app company; Warby Parker, a disruptive eyewear retailer; Stripe, the online payment processing platform; Airbnb, the global lodging marketplace; and Deliveroo, a prominent food delivery service.

Headquarters: Cambridge, Massachusetts, United States

Active Investments in: United States

Key Investments: Snap, Warby Parker, Stripe, Airbnb, Deliveroo

500 Startups (500 Global)

As its name suggests, 500 Startups is a startup accelerator and VC firm with a mission to back a vast number of startups. Its global reach encompasses investments in over 75 countries, making it one of the most geographically diverse venture capital firms. Focused on early-stage investments, 500 Startups aims to discover and support promising startups in emerging markets, empowering entrepreneurs from all corners of the world.

Their key investments showcase 500 Startups’ focus on backing diverse and innovative startups with the potential for substantial growth and impact in their respective industries

Headquarters: San Francisco, California, United States

Active Investments in: Global (Investments in over 75 countries)

Key Investments: Credit Karma, Canva, Udemy, Udacity, Grab

Insight Partners

Insight Partners is a leading global venture capital and private equity firm that invests in high-growth technology companies. The firm’s substantial investments have been crucial in propelling startups to success.

Some of its key investments include Twitter, the microblogging platform; Shopify, the e-commerce platform; DocuSign, the electronic signature technology company; Qualtrics, the experience management platform; and Wix, the website builder platform.

Headquarters: New York City, New York, United States

Active Investments in: United States, Europe, Israel

Key Investments: Twitter, Shopify, DocuSign, Qualtrics, Wix

Northzone

Northzone is a venture capital firm that focuses on early-stage investments in technology and consumer startups. With offices in both Europe and the United States, the firm has a strong presence in the global startup ecosystem.

Key investments by Northzone include Spotify, the music streaming service; Klarna, the fintech company offering payment solutions; iZettle, a mobile payments platform; Trustpilot, the online review platform; and FuboTV, a live TV streaming service.

Headquarters: Stockholm, Sweden

Active Investments in: Europe, United States

Key Investments: Spotify, Klarna, iZettle, Trustpilot, FuboTV

Institutional Venture Partners (IVP)

IVP is a premier venture capital firm that has been a significant player in the technology and growth equity space since its establishment in 1980. With headquarters in Menlo Park, California, IVP has a strong presence in Silicon Valley and the broader tech ecosystem. The firm is known for its investments in late-stage startups and has backed numerous industry-leading companies. IVP’s diverse portfolio spans across sectors such as enterprise software, consumer internet, fintech, and healthcare. With a seasoned team and a track record of successful exits, IVP continues to play a vital role in supporting startups on their growth journey.

Headquarters: Menlo Park, California, United States

Active Investments in: United States

Key Investments: Dropbox, Twitter, Snap, Slack, Robinhood

Khosla Ventures

Founded by renowned venture capitalist Vinod Khosla, Khosla Ventures is a venture capital firm based in Menlo Park, California. The firm has gained prominence for its investments in cutting-edge technologies and disruptive innovations. Khosla Ventures takes a bold approach, backing startups with ambitious visions that have the potential to transform industries and solve significant global challenges. The firm’s investments span a wide range of sectors, including clean energy, biotechnology, artificial intelligence, and more. Khosla Ventures’ visionary leadership and commitment to driving positive change have earned it a reputation as a leading force in the venture capital landscape.

Headquarters: Menlo Park, California, United States

Active Investments in: United States

Key Investments: Square, DoorDash, Okta, Affirm, BioNTech

AUM: approx. $14 billion

Dragoneer Investment Group

DIG (Dragoneer Investment Group) is a renowned venture capital firm known for its strategic investments in high-growth startups and established technology companies. With a focus on long-term value creation, DIG seeks out visionary founders and disruptive innovations across various industries. Their extensive experience and expertise have earned them a reputation as a key player in the global investment landscape. As a forward-thinking VC firm, Dragoneer Investment Group aims to propel entrepreneurs to new heights and positively impact the world through its transformative partnerships and unwavering support.

Headquarters: San Francisco, California, United States

Active Investments in: United States, China, India, Israel, and other regions globally.

Key Investments: Airbnb, Apple, Google (Alphabet), WhatsApp, Dropbox, LinkedIn, Stripe, Zoom, Snowflake, ByteDance (TikTok), and many more.

Number of Investments: Over 150

AUM: Approx. $25 billion

Draper Fisher Jurvetson Management (DFJ)

Draper Fisher Jurvetson, commonly known as DFJ, is a renowned venture capital firm with a strong presence in the technology and startup ecosystem. With its headquarters in Menlo Park, California, DFJ has been a prominent player in Silicon Valley since its founding in 1985. The firm focuses on investing in early-stage and disruptive technology startups, nurturing visionary founders with innovative ideas. DFJ’s extensive portfolio spans various industries, including technology, healthcare, and clean energy. Through its strategic investments and guidance, DFJ aims to support startups in realizing their full potential and becoming industry leaders.

Headquarters: Menlo Park, California, United States

Active Investments in: United States, Europe, and other regions globally.

Key Investments: As a tech-focused VC firm, DFJ has been associated with several high-profile investments in transformative companies. Some key investments include SpaceX, Tesla, Twitter, Coinbase, Baidu, Skype, Box, Unity, and DocuSign, among others.

Number of Investments: Over 500

AUM: Approx. $3 billion

Greylock Partners

Greylock Partners is a prestigious venture capital firm with a rich history of supporting early-stage and growth-stage startups. Headquartered in Menlo Park, California, Greylock has been a prominent player in Silicon Valley and the global technology ecosystem since its founding in 1965. The firm focuses on backing entrepreneurs with bold visions and disruptive ideas across various sectors, including technology, consumer, and enterprise. Greylock’s seasoned team of investors provides valuable mentorship and strategic guidance to its portfolio companies. With a successful track record and a commitment to fostering innovation, Greylock Partners continues to be a driving force behind some of the most influential companies in the technology industry.

Headquarters: Menlo Park, California, United States

Active Investments in: United States, Europe, and other regions globally.

Key Investments: As a tech-focused VC firm, Greylock Partners has been associated with several transformative investments. Some key investments include Airbnb, LinkedIn, Facebook, Dropbox, Workday, Roblox, Okta, and AppDynamics, among others.

Number of Investments: Over 400

AUM: Approx. $4 billion

IDG Capital

IDG Capital is a prominent venture capital firm that focuses on early-stage and growth-stage investments in technology, media, and telecommunications sectors. With its headquarters in Beijing, China, IDG Capital has a strong presence in the Asian and global startup ecosystem. The firm is known for its strategic investments in innovative companies with disruptive potential. IDG Capital’s extensive network and expertise provide valuable resources and support to its portfolio companies, helping them scale and succeed in their respective markets. With a successful track record of investments, IDG Capital continues to play a vital role in shaping the technology landscape and driving innovation worldwide.

Headquarters: Beijing, China

Active Investments in: China, United States, and other regions globally.

Key Investments: As a venture capital firm with a focus on technology and media, IDG Capital has been associated with several notable investments. Some key investments include Tencent, Xiaomi, Baidu, Meituan Dianping, Qunar, Sohu, and Ctrip, among others.

Number of Investments: Over 300

AUM: Over $5 billion

Tencent Group

Tencent is not a typical Venture Capital Firm, but is very active in tech startup investments worldwide. Tencent Group, based in Shenzhen, China, is a leading technology conglomerate with a diverse portfolio of investments and subsidiaries. Established in 1998, Tencent has become one of the largest and most influential technology companies globally. The group’s activities span various sectors, including social media, gaming, entertainment, e-commerce, cloud computing, and fintech.

Tencent’s investments and strategic partnerships have contributed to its growth and expansion into multiple markets both in China and internationally. With its commitment to innovation and user-centric approach, Tencent continues to be a major force in shaping the digital landscape and revolutionizing the way people interact and conduct business.

Headquarters: Shenzhen, China

Active Investments in: China, United States, Europe and other regions globally.

Key Investments: Tencent has an extensive list of investments and acquisitions across various industries. Some key investments include stakes in companies like JD.com, Meituan-Dianping, Huya Inc., Spotify, Epic Games, Riot Games, Supercell (Finnish unicorn gaming company known for Clash of Clans), Snap Inc (owner of Snapchat) and dozens of others.

Naspers

Naspers is a South African multinational media and technology conglomerate with a significant presence in the global tech and internet industries. Founded in 1915, the company has evolved from a newspaper publisher to a diversified tech investor and operator.

Naspers is well-known for its early investment in Tencent, the Chinese tech giant, which has become one of the world’s largest technology companies. With its focus on internet services, e-commerce, and online classifieds, Naspers has made strategic investments in various countries and regions, contributing to its growth and international influence. As a forward-thinking company, Naspers continues to explore new opportunities and innovate in the digital space, making it a prominent player in the global tech ecosystem.

Headquarters: Cape Town, South Africa

Active Investments in: South Africa, China, India, Europe, and other regions globally.

Key Investments: Naspers’ key investments include a significant stake in Tencent, which has been the cornerstone of its investment success. Additionally, the company has made investments in global internet and tech companies like Delivery Hero, OLX Group, Avito, and MakeMyTrip, among others.

Disclaimer:

Please note that the list of countries/regions where these VC firms actively invest is not exhaustive, as they may have investments in other parts of the world as well. Additionally, their investment focus and scope may change over time based on market conditions and strategic decisions.

Also the number of investments and AUM can fluctuate over time due to new investments, divestitures, and changes in fund sizes. For the most current and accurate information, it’s best to refer to the respective VC firms’ official sources or recent financial reports.

AUM data for all VC firms is sourced from the Sovereign Wealth Fund Institute.

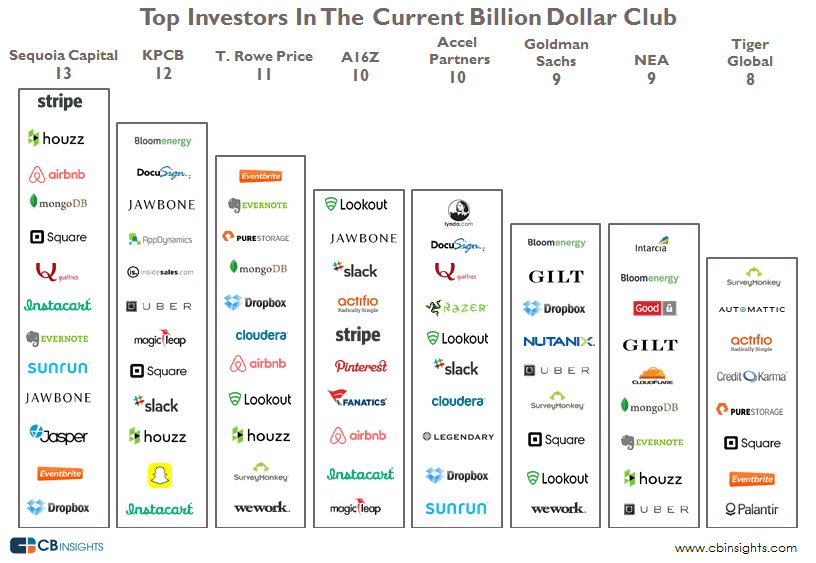

Top Venture Capital Firms in the Global Unicorn Club

Top venture capital firms, such as Sequoia Capital, Accel Partners, Andreessen Horowitz, Benchmark, and 500 Startups, have a remarkable track record of backing numerous unicorns – startups valued at over $1 billion. These unicorns have disrupted industries and reshaped the global business landscape.

Some notable examples include Airbnb, the peer-to-peer lodging platform; Stripe, the online payment processor; Robinhood, the commission-free stock trading app; and Snapchat (now Snap Inc.), the multimedia messaging app. These VC firms’ strategic investments and unwavering support have played a pivotal role in turning these startups into industry leaders and symbols of innovation, revolutionizing how we live, work, and interact in the digital age.

The venture capital landscape has evolved into a global arena, with numerous firms expanding their horizons beyond their home countries. The top VC firms mentioned in this article have demonstrated their prowess in identifying and backing innovative startups worldwide, catalyzing technological advancements and economic growth on a global scale. As these firms continue to scout for transformative ideas and support entrepreneurial talent, they will play a pivotal role in shaping the future of industries and society at large.