The journey of transforming a groundbreaking idea into a successful startup is an exhilarating and challenging endeavor. One of the critical aspects that entrepreneurs must navigate along this path is securing funding at various stages of their startup’s growth. Understanding the different startup funding stages and their significance is thus vital for entrepreneurs seeking the financial resources necessary to fuel innovation, scale operations, and achieve long-term success.

In this post, we'll cover:

- 1 Understanding Startup Funding Stages

- 2 Pre-Seed Funding

- 3 Seed Funding

- 4 Difference between Pre-Seed Funding and Seed Funding

- 5 Startup Series A Funding Stage Explained

- 6 So, when is a startup ready for Series A funding Stage?

- 7 Series B Funding

- 8 Fueling Expansion: Growth (Series) Funding Stages for Startups

- 9 Bridge Financing

- 10 Debt Financing

- 11 Crowdfunding

- 12 Initial Coin Offering (ICO)

- 13 Initial Public Offering (IPO)

- 14 Conclusion – Startup Funding Stages Explained

Understanding Startup Funding Stages

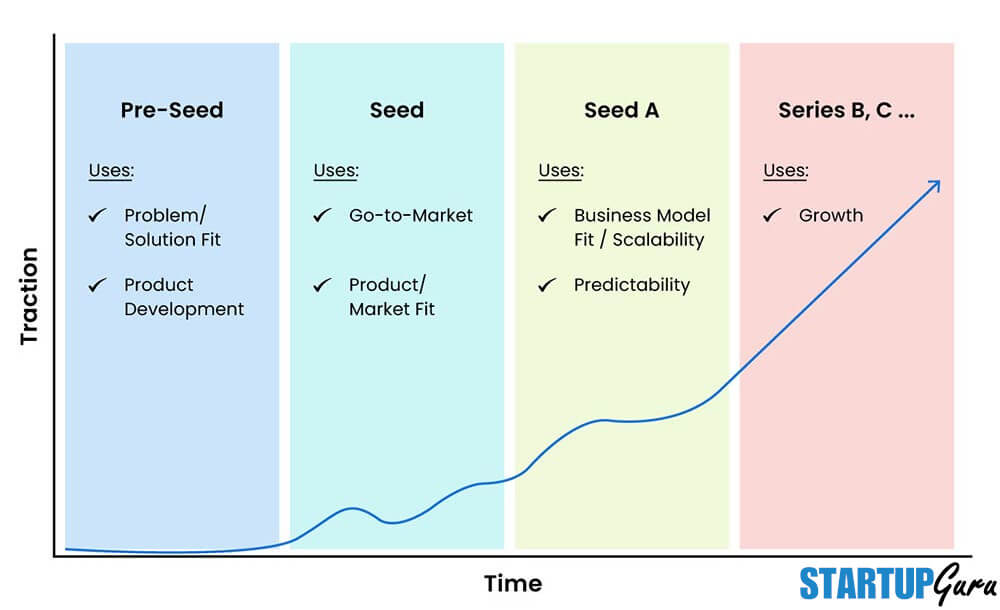

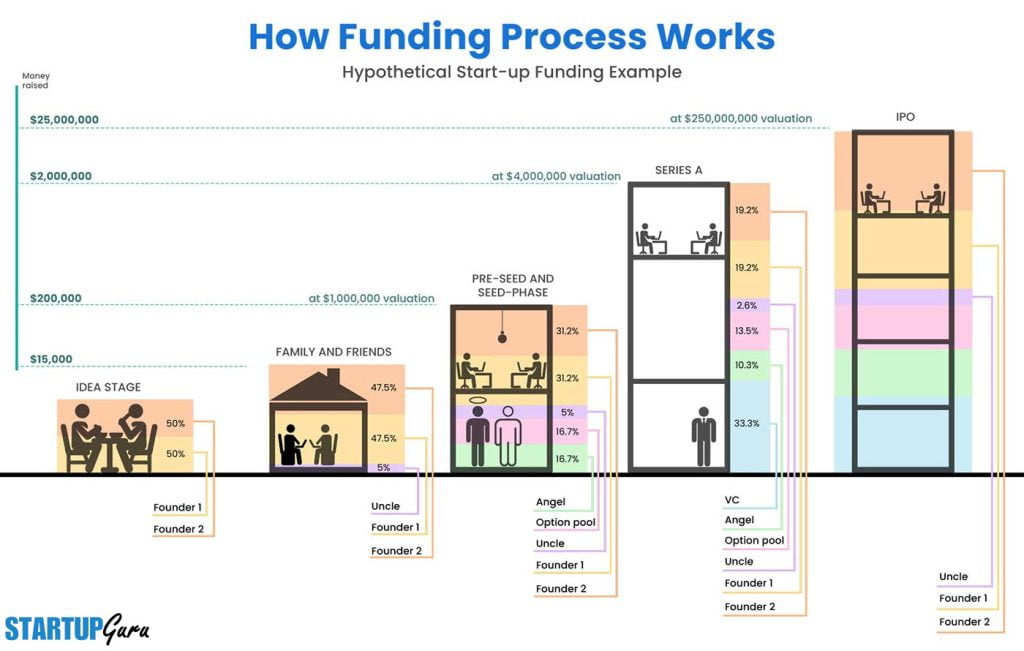

Startup funding stages represent the distinct phases in a startup’s lifecycle, where entrepreneurs raise capital to support different aspects of their business growth. From the early stages of ideation and development to the later stages of scaling and expansion, each startup funding stage serves a unique purpose, helping startups overcome challenges, validate their ideas, attract talent, and propel their ventures forward.

By comprehending these stages of funding for a startup and the opportunities they present, entrepreneurs can better strategize, navigate the fundraising landscape, and secure the right funding at the right time to fuel their entrepreneurial dreams.

So far, for the second quarter of 2023, investors put $31.8 billion into different startup funding stages from seed to growth for U.S. and Canadian startups, according to preliminary Crunchbase data. That’s by far the lowest quarterly total in more than three years.

The above chart represents quarterly investment totals, color-coded by stage, for the past 10 quarters for the North American startups. As you can see, there is a YoY decline of -50%. Even the angel seed round has drastically declined to $3.4 billion in Q1 23 from $6.1 billion in Q1 22. By understanding how startup funding trends and amounts vary for different startup funding stages, you as a founder would be better informed to take advantage of this knowledge.

Startup Funding Rounds

In this article, we will delve into the intricacies of different stages of startup funding, exploring their significance, the key players involved, and the strategies entrepreneurs can employ to secure the funding needed to propel their startups towards success.

The following are the typical startup funding stages (different rounds of funding):

- Pre-Seed funding

- Seed funding

- Series A funding

- Series B funding

- Growth stage funding

- Bridge financing

- Debt financing & Loans

- Crowdfunding

- Initial coin offering (ICO)

- Initial public offering (IPO)

Pre-Seed Funding

Pre-seed funding is the initial capital raised by startups in their earliest funding phases, usually before they have a fully developed product or significant customer traction. It is an essential stepping stone that helps entrepreneurs validate their ideas, build a minimum viable product (MVP), conduct market research, and attract talent to the team.

This early funding stage represents the earliest stage of external financing for startups. It typically occurs in the ideation or concept development phase when the startup is still in its infancy. This form of funding is often sourced from personal savings, friends and family (F&F), or angel investors who believe in the potential of the entrepreneur and their idea (in most of the cases, these angels already know the founders well if they enter at pre-seed stage).

The primary objective of pre-seed funding is to provide initial capital to transform a concept into a viable business model or minimum viable product (MVP). This funding is used to conduct market research, develop prototypes, validate ideas, and build a founding team.

Key Players in Pre-Seed Funding

Founders: The visionary individuals who conceptualize the startup, create a business plan, and seek funding to turn their vision into reality.

Angel Investors: High-net-worth individuals who invest their personal funds in promising startups in exchange for equity. Angel investors often provide not only financial support but also mentorship and valuable industry connections.

Friends and Family: Close friends and family members who believe in the founder’s vision and contribute capital to help kickstart the business.

Incubators and Accelerators: Programs that provide mentorship, resources, and funding to early-stage startups in exchange for equity. These organizations often offer a structured curriculum to help startups refine their ideas and build a solid foundation.

Strategies for Securing Pre-Seed Funding

Develop a compelling pitch: Craft a clear and concise pitch that communicates the problem your startup solves, your unique value proposition, and the market potential. Highlight the passion and expertise of your team to instill confidence in potential investors.

Build a strong network: Attend startup events, join entrepreneurial communities, and leverage social media platforms to connect with potential investors. Networking opens doors to opportunities, introductions, and potential funding sources.

Create a robust business plan: Outline your startup’s mission, target market, competitive landscape, and revenue model. Show potential investors that you have conducted thorough market research and have a solid strategy for growth.

Proof of concept: Even without a fully developed product, demonstrate your idea’s feasibility and market demand through prototypes, surveys, or early customer feedback. This evidence can instill confidence in investors.

Leverage incubators and accelerators: Apply to reputable startup programs that provide not only funding but also mentorship, industry connections, and access to resources. These programs can significantly enhance your chances of securing pre-seed funding.

Perfect your pitch deck: Create a visually appealing and compelling pitch deck that tells a compelling story about your startup. Highlight the problem, solution, target market, competitive advantage, and financial projections.

When a startup should consider Pre-Seed Funding?

Pre-seed funding acts as a launchpad for early-stage startups, providing the necessary resources to validate ideas, build an MVP, and attract talent. By understanding the significance of pre-seed funding, cultivating relationships with key players, and implementing effective strategies, entrepreneurs can increase their chances of securing the vital capital needed to transform their vision into a thriving startup.

Remember, persistence and resilience are crucial throughout the funding journey, and each “no” brings you one step closer to finding the right investor who believes in your startup’s potential.

Seed Funding

It represents the initial investment (the first external funding round from professional investors in most cases) raised by startups to establish their operations, refine their product or service offerings, and validate market demand. Seed funding is the next level of early stage funding for startups. It typically occurs after the founders have developed their business plan, conducted market research, and built a minimum viable product (MVP). Seed funding serves as a crucial catalyst for growth, enabling startups to execute their plans and attract additional investments.

Key Players in Seed Funding

Venture Capital Firms (Seed VCs): These firms specialize in investing in high-potential startups in exchange for equity. VCs often provide not only financial support but also mentorship, industry expertise, and access to valuable networks.

Note there are different type of VCs that enter at seed stage called Seed VCs, and they have a different approach and investment thesis than the growth stage VCs, which we will explain later in this article.

Angel Investors: Individuals who invest their personal capital in startups, often in the early stages. Angel investors are typically successful entrepreneurs, industry experts, or high-net-worth individuals who provide funding, guidance, and valuable connections.

Incubators and Accelerators: Programs that support early-stage startups by providing resources, mentorship, and funding in exchange for equity. These organizations offer structured programs designed to nurture startups and help them achieve key milestones.

Learn more – World’s best startup accelerators

Crowdfunding Platforms: Online platforms that enable entrepreneurs to raise funds from a large number of individuals who believe in their vision. Crowdfunding allows startups to validate their concept while building a community of supporters.

Effective Strategies for Securing Seed Funding

Refine Your Business Plan: Develop a comprehensive business plan that clearly outlines your startup’s vision, target market, revenue model, competitive landscape, and growth strategy. Demonstrating a solid understanding of your market and competitive advantage is crucial in attracting seed funding.

Build a Strong Network: Attend industry events, join startup communities, and leverage online platforms to connect with potential investors. Networking opens doors to valuable introductions, mentorship opportunities, and potential funding sources.

Showcase Your MVP: Develop a compelling minimum viable product (MVP) that demonstrates the core functionality and value proposition of your offering. A tangible prototype or beta version can help investors visualize your startup’s potential and market fit.

Create an Engaging Pitch Deck: Craft a visually appealing and persuasive pitch deck that effectively communicates your startup’s mission, market opportunity, unique selling points, and financial projections. Tailor your pitch deck to align with the preferences and expectations of potential investors.

Leverage Incubators and Accelerators: Apply to reputable incubator or accelerator programs that provide funding, mentorship, and resources tailored to early-stage startups. These programs offer invaluable guidance and connections to investors within their networks.

Prepare for Due Diligence: Anticipate investor due diligence by organizing your legal documents, financial statements, intellectual property rights, and any other pertinent information. Being prepared and transparent during the due diligence process builds investor confidence.

So, when a startup should consider Seed Funding?

Seed funding acts as a critical fuel for startups, providing the necessary resources to refine their products, validate market demand, and scale their operations. By understanding the significance of seed funding, fostering relationships with key players, and implementing effective strategies, entrepreneurs can increase their chances of securing the vital early-stage capital required for sustainable growth.

Remember, building a compelling business case, nurturing a strong network, and showcasing the potential of your startup are key steps on the path to securing seed funding and transforming your entrepreneurial vision into a thriving reality.

Difference between Pre-Seed Funding and Seed Funding

Both the pre-seed funding and seed funding stages are types of early stage startup funding. In the journey of transforming an idea into a successful startup, pre-seed and seed funding stages play critical roles in providing the necessary capital for growth and development.

Pre-seed funding helps entrepreneurs validate their ideas, build prototypes, and assemble a founding team.

Seed funding, on the other hand, enables startups to scale their operations, achieve market traction, and execute their growth strategies. By understanding the nuances and requirements of each funding stage, entrepreneurs can strategically position themselves to attract the right investors and propel their startups towards long-term success.

Key Features of Pre-Seed Funding

Limited Capital: Pre-seed funding amounts are generally smaller compared to later funding stages. The focus is on providing enough capital to get the startup off the ground and reach the next milestone.

High Risk: At the pre-seed stage, startups are in the early stages of development and face significant uncertainties and risks. Investors investing in early stage startups take a leap of faith, betting on the entrepreneur’s vision, capabilities, and market potential.

Informal Investors: Pre-seed funding often comes from personal networks, angel investors, or small investment groups interested in supporting early-stage ventures.

Product Validation: The primary goal of pre-seed funding is to develop a proof of concept or MVP and validate the product-market fit. The startup focuses on gathering user feedback and refining its value proposition.

Key Features of Seed Funding

Increased Capital: Seed funding rounds generally involve larger investment amounts compared to pre-seed funding. This infusion of capital helps startups grow their business, penetrate the market, and execute their expansion plans.

Market Traction: Startups seeking seed funding should showcase early signs of market traction, such as customer acquisition, revenue generation, or user engagement. Investors look for evidence that the startup’s product or service has resonated with the target market.

Professional Investors: This early funding stage typically involves investments from angel investors, early-stage venture capital firms, or specialized seed-stage funds. These investors provide not only capital but also expertise, guidance, and industry connections to support the startup’s growth.

Growth Potential: Seed funding is focused on scaling operations, expanding the team, and capturing a larger market share. Startups at this stage are expected to have a clear growth strategy and a path to profitability.

Startup Series A Funding Stage Explained

Series A funding typically occurs after a startup has gained initial traction, developed a minimum viable product (MVP), and demonstrated market validation. At this stage, startups are ready to scale their operations, penetrate new markets, and invest in expanding their team and infrastructure. Series A funding enables entrepreneurs to accelerate their growth trajectory by securing substantial investments to support marketing efforts, product development, and customer acquisition.

Key Players in Series A Funding

Venture Capital Firms (VCs): Series A funding is predominantly provided by venture capital firms. These firms specialize in investing in high-potential startups in exchange for equity. VCs bring not only financial capital but also industry expertise, mentorship, and valuable connections to help startups scale and achieve their growth targets.

Angel Investors: While Series A funding is often associated with venture capital, angel investors can also participate in this funding round. Angel investors are typically experienced entrepreneurs or high-net-worth individuals who provide capital, guidance, and industry connections to startups.

Strategic Investors: At the Series A stage, strategic investors, such as corporations or established companies in related industries, may participate. Strategic investors can provide more than just financial capital; they offer market insights, distribution channels, and potential partnerships that can fuel startup growth.

Strategies for Successfully Raising Series A Funding

Develop a Compelling Growth Story: Craft a persuasive narrative that outlines the startup’s progress, market potential, and growth projections. Clearly articulate how the Series A funding will be utilized to drive expansion and generate significant returns for investors.

Demonstrate Strong Traction and Market Validation: Showcase key metrics, such as revenue growth, customer acquisition, user engagement, or partnerships, to demonstrate market traction and validate the startup’s value proposition. Concrete evidence of product-market fit and customer demand significantly enhances the chances of securing Series A funding.

Build a Stellar Team: Investors often emphasize the quality of the founding team and their ability to execute the business plan. Assemble a team with complementary skills, domain expertise, and a track record of success to instill confidence in potential investors.

Expand and Leverage Your Network: Actively engage with industry influencers, attend networking events, and leverage existing connections to build relationships with potential Series A investors. A warm introduction or referral from a trusted source can greatly increase the likelihood of securing funding.

Prepare a Comprehensive Pitch Deck: Create a well-structured and visually compelling pitch deck that highlights the startup’s value proposition, market opportunity, competitive advantage, financial projections, and the potential return on investment for Series A investors. Tailor the pitch deck to align with the interests and expectations of venture capital firms and other potential investors.

So, when is a startup ready for Series A funding Stage?

Series A funding marks a critical inflection point for startups, providing the financial resources required to accelerate growth, scale operations, and solidify market presence. By understanding the significance of Series A funding, fostering relationships with key investors, and implementing effective fundraising strategies, entrepreneurs can increase their chances of securing the necessary capital to propel their startups to new heights.

As entrepreneurs embark on their Series A fundraising journey, it is vital to showcase strong traction, build a stellar team, and craft a compelling growth story that resonates with investors. With careful planning, persistence, and a well-executed strategy, startups can navigate the Series A funding landscape successfully and achieve their ambitious growth objectives.

Series B Funding

Series B funding represents the next phase in a startup’s fundraising journey, typically following successful completion of Series A funding. At this stage, startups have already validated their business model, demonstrated market traction, and are now focused on scaling their operations to capture a larger market share. Series B funding enables startups to invest in critical areas such as sales and marketing, product development, talent acquisition, and infrastructure expansion, allowing them to solidify their position and dominate their industry.

Key Players in Series B Funding

Venture Capital Firms (VCs): Series B funding is primarily provided by venture capital firms that specialize in growth-stage investments. VCs at this stage are looking for startups with a proven track record of success, significant market potential, and the ability to achieve rapid growth. They bring not only financial capital but also strategic guidance, industry connections, and expertise to fuel startups’ expansion plans.

Private Equity Firms: In some cases, private equity firms may participate in Series B funding rounds. These firms typically invest in more mature startups that are on the cusp of profitability or have a clear path to achieving it. Private equity firms can bring additional operational expertise and a focus on scaling businesses to new heights.

Strategic Investors: At the Series B stage of startup funding, strategic investors such as corporate venture capital arms or established companies in related industries may also participate. Strategic investors not only provide financial support but also offer valuable partnerships, distribution channels, and market insights, which can significantly accelerate startups’ growth and market penetration.

Strategies for Successfully Raising Series B Funding

Showcase Strong Growth Metrics: Startups seeking Series B funding should demonstrate substantial growth and solidify their position in the market. Key metrics such as revenue growth, customer acquisition, user engagement, and market share expansion will be crucial in attracting investors. Providing tangible evidence of scalability and a clear path to profitability will instill confidence in potential Series B investors.

Highlight Competitive Advantages: Differentiate your startup by showcasing unique selling points, competitive advantages, and barriers to entry that set you apart from competitors. Emphasize intellectual property, proprietary technology, or unique market positioning to capture the attention of investors seeking opportunities with significant market potential.

Strengthen Partnerships and Alliances: Forge strategic partnerships with industry leaders or complementary businesses that can bolster your market presence and enhance your growth prospects. Highlight existing partnerships and alliances that demonstrate your ability to navigate the market successfully and expand your reach.

Leverage Existing Investors: Engage with your existing investors from the previous funding rounds and leverage their networks and industry connections to explore potential Series B investors. Building strong relationships with existing investors is vital as they can serve as advocates for your startup and vouch for its potential.

Refine Your Business Plan and Financial Projections: Develop a comprehensive business plan that articulates your growth strategy, market opportunity, and financial projections for the Series B funding round. Investors will scrutinize your plans and projections to assess the scalability and sustainability of your business.

Having Series B readiness

Series B funding represents a significant milestone in a startup’s growth journey, providing the necessary capital to scale operations, strengthen market position, and achieve dominance in the industry. By understanding the importance of Series B funding, cultivating relationships with key investors, and implementing

Fueling Expansion: Growth (Series) Funding Stages for Startups

As startups evolve and gain momentum, they often require substantial capital infusion to fuel their expansion plans and solidify their market position. Growth stage funding, also known as VC funding, Series C or later-stage funding, plays a pivotal role in empowering startups to scale rapidly, enter new markets, and capitalize on emerging opportunities. In this blog post, we will delve into the realm of growth stage of startup funding, exploring its significance, the key players involved, and strategies that startups can employ to secure this critical capital for their next phase of growth.

Understanding Growth Series Funding Stages

Growth stage funding represents the funding rounds that occur after the early-stage funding rounds (such as Seed, Series A, and Series B). At this stage, startups have already proven their market viability, achieved significant traction, and demonstrated a sustainable revenue model. Growth stage funding aims to provide the necessary financial resources to drive aggressive expansion, support large-scale operations, and solidify market dominance.

Key Players in Growth Stage Funding

Venture Capital Firms (VCs): VCs continue to play a significant role in growth stage funding by providing substantial investments to fuel startup expansion. At this stage, VCs are looking for startups with a proven track record of success, substantial revenue growth, and the potential to become industry leaders. They bring not only financial support but also strategic guidance, industry expertise, and valuable connections to fuel startups’ scaling ambitions.

Private Equity Firms: Private equity firms may also participate in growth stage funding rounds. These firms typically invest in more mature startups that have reached a level of stability and are poised for significant growth. Private equity firms bring operational expertise, managerial support, and a focus on scaling businesses to new heights.

Note that PE firms enter mostly (if not only) during the later growth stages, unlike VC firms. Most PE firms have a definite exit plan which is either to sell their stake to other ecosystem players or to take the startup to IPO.

Corporate Venture Capital (CVC): Some growth stage funding rounds may involve participation from corporate venture capital arms of established companies. These corporations seek strategic investments that align with their business interests and provide potential synergies. CVCs offer startups not only financial resources but also the opportunity for strategic partnerships, distribution channels, and access to their extensive networks.

Strategies for Successfully Raising Growth Stage Funding

Demonstrate Strong Growth Metrics: Startups seeking growth stage funding must showcase impressive growth metrics, such as revenue growth, customer acquisition, market share expansion, and profitability. Providing concrete evidence of scalable operations and a clear path to sustained growth will be crucial in attracting investors at this stage.

Emphasize Market Leadership: Highlight your startup’s position as a market leader or disruptor within your industry. Showcase your competitive advantage, unique value proposition, and barriers to entry that differentiate your business from competitors. Investors at the growth stage are particularly interested in startups that have the potential to dominate their market segment.

Leverage Strategic Partnerships: Forge strategic partnerships with established industry players, suppliers, distributors, or complementary businesses. These partnerships can demonstrate your startup’s ability to navigate the market successfully, expand your customer base, and access new markets. Investors value partnerships that strengthen your market position and provide additional growth opportunities.

Communicate Scalability and Long-Term Vision: Present a well-defined growth strategy and a clear vision for the future. Investors want to see that you have a scalable business model, a plan for sustainable expansion, and a vision to capitalize on emerging trends and market opportunities. Articulate how growth stage funding will be utilized to fuel your expansion plans and achieve long-term profitability.

Engage with Existing Investors: Maintain strong relationships with existing investors and leverage their networks and expertise to explore potential growth stage investors. Existing investors who have witnessed your startup’s journey and growth can serve as strong advocates, vouching for the potential of your business.

Is your startup ready for growth stage funding?

Growth stage funding marks a significant milestone in a startup’s journey, providing the necessary capital to propel rapid expansion and solidify market dominance. By understanding the significance of growth stage funding, cultivating relationships with key investors, and effectively communicating the scalability and potential of your business, startups can position themselves for success in securing the critical capital required to fuel their next phase of growth. With careful planning, strategic partnerships, and a compelling growth strategy, startups can leverage growth stage funding to accelerate their journey towards becoming industry leaders.

Bridge Financing

For startups navigating the complex landscape of funding, bridge financing emerges as a crucial mechanism to bridge the gap between funding rounds and sustain momentum. Also known as bridge loans or bridge rounds, bridge financing provides temporary capital to startups, ensuring their operations continue smoothly while they prepare for their next significant funding milestone. So, let’s explore the concept of bridge financing, its significance for startups, key players involved, and strategies for effectively utilizing this funding mechanism to fuel growth and success.

Understanding Bridge Financing

Bridge financing serves as a financial lifeline for startups facing a temporary cash flow challenge between funding rounds. It typically occurs when a startup has depleted its existing capital from previous funding rounds but is not yet ready for the next major funding event. Bridge financing acts as a short-term solution, providing immediate capital infusion to support ongoing operations, product development, customer acquisition, or any other critical business activities.

Key Features of Bridge Financing

Short-Term Solution: Bridge financing is designed to provide temporary funding until the next significant funding event, such as a Series A or Series B round, is secured. It offers startups a financial cushion to sustain operations, meet short-term obligations, and maintain momentum during critical transition periods.

Faster Access to Capital: Bridge financing is often structured to facilitate a quick and efficient funding process. Startups can secure this financing through existing investors, angel investors, venture capital firms, or specialized bridge financing providers. Compared to traditional funding rounds, bridge financing can be secured relatively faster, allowing startups to address immediate funding needs promptly.

Flexible Terms: Bridge financing terms can vary, but they generally include a higher interest rate or convertible debt structure. Startups may opt for convertible notes, which can later convert into equity when the subsequent funding round occurs. The flexibility in terms provides startups with short-term financial relief while negotiating better terms for the future funding round.

Use Cases: Bridge financing can be utilized for various purposes, including product development, market expansion, hiring key personnel, refining business models, or enhancing infrastructure. Startups can strategically allocate the bridge capital to address immediate needs and enhance their overall value proposition.

Key Players in Bridge Financing

Existing Investors: In many cases, existing investors, including angel investors and venture capital firms, may participate in bridge financing rounds to support their portfolio startups. These investors demonstrate their continued confidence in the startup’s potential and provide interim capital to ensure its sustained growth.

Specialized Bridge Financing Firms: Some firms specialize in providing bridge financing to startups. These firms understand the unique funding challenges startups face and offer tailored solutions to bridge the financial gap. They often work closely with startups to structure bridge financing deals that align with their growth objectives.

Strategies for Effective Bridge Financing

Clear Communication: Startups seeking bridge financing should clearly communicate their funding needs, current financial situation, and growth plans to potential investors. Transparent communication helps build trust and showcases the startup’s commitment to meeting its milestones.

Milestone Focus: Bridge financing should be strategically aligned with achieving specific milestones that will enhance the startup’s valuation and attractiveness to future investors. Clearly defining these milestones and demonstrating progress towards them increases the chances of securing subsequent funding rounds successfully.

Investor Alignment: Startups should seek bridge financing from investors who are aligned with their long-term vision and growth plans. Investors who understand the startup’s industry, business model, and market potential can provide valuable insights, connections, and support beyond the financial aspect.

Post-Funding Planning: Startups should use the bridge financing period to diligently plan for the subsequent funding round. This includes refining the business model, strengthening the team, optimizing operations, and showcasing tangible progress to potential investors.

Is bridge financing an option for your startup?

Bridge financing plays a critical role in supporting startups during transitional periods between significant funding rounds. By securing temporary capital, startups can bridge the gap, sustain operations, and continue their growth trajectory. With effective communication, milestone-focused strategies, and investor alignment, startups can leverage bridge financing to navigate funding challenges and position themselves for long-term success in the dynamic startup ecosystem.

Debt Financing

When it comes to financing options for startups, debt financing provides an alternative avenue for securing capital to fuel growth and expansion. Unlike equity financing, which involves selling ownership stakes, debt financing involves borrowing funds that are to be repaid with interest over a specified period. Let’s explore the concept of debt financing for startups, its significance, key considerations, and potential benefits and challenges associated with this traditional funding approach.

Understanding Debt Financing

Debt financing is a funding method where startups borrow capital from lenders, such as banks, financial institutions, or private lenders, with an agreement to repay the borrowed amount plus interest over a predetermined period.

Startups can utilize debt financing to finance various aspects of their business, including operations, inventory management, equipment purchases, marketing initiatives, or expansion plans. This approach allows startups to access capital while maintaining ownership and control over their business.

Key Features of Debt Financing

Borrowed Capital: Debt financing provides startups with borrowed capital that must be repaid to the lender over a specified period. The borrowed funds can be used for various purposes, depending on the startup’s specific needs and growth objectives.

Interest and Repayment Terms: Debt financing involves the repayment of the borrowed capital along with interest over a predetermined period. Interest rates can vary depending on the type of debt instrument, creditworthiness of the startup, and prevailing market conditions.

Collateral and Security: In some cases, lenders may require collateral or security to mitigate their risk. Startups may need to provide assets or personal guarantees as collateral, ensuring that the lender has recourse in case of default.

Different Forms of Debt: Debt financing can take different forms, including term loans, lines of credit, equipment financing, invoice financing, or Small Business Administration (SBA) loans. Startups can explore various debt instruments based on their specific funding requirements.

Considerations for Startups Exploring Debt Financing

Financial Viability: Startups considering debt financing should evaluate their financial viability, including cash flow, revenue projections, and ability to generate consistent income to service the debt. Lenders assess the startup’s financial health and creditworthiness before extending credit.

Risk Management: Startups must carefully assess the risks associated with debt financing, including the potential impact on cash flow, interest rate fluctuations, and repayment obligations. A thorough risk management strategy is crucial to ensure the sustainability of the business and avoid default.

Lender Relationships: Building relationships with lenders is important for startups seeking debt financing. Establishing trust, maintaining open communication, and demonstrating a strong business plan are key to securing favorable terms and conditions.

Benefits and Challenges of Debt Financing for Startups

Benefits:

Retained Ownership and Control: Debt financing allows startups to retain ownership and control over their business since they are not required to sell equity or ownership stakes. This preserves the decision-making power and future potential value of the company.

Interest Deductibility: In many cases, interest paid on debt financing is tax-deductible, reducing the overall tax burden on the startup. This can positively impact the startup’s financial position and cash flow.

Building Creditworthiness: Successfully managing debt obligations and making timely repayments can help startups build a positive credit history, improving their creditworthiness and opening doors to future financing opportunities.

Challenges:

Debt Servicing Obligations: Startups must carefully manage their cash flow to meet debt repayment obligations, which can sometimes strain financial resources. Failure to meet debt obligations can lead to default and damage the startup’s credit rating.

Interest Expenses: Debt financing involves interest payments, which increase the overall cost of capital for the startup. Higher interest rates or unfavorable repayment terms can impact profitability and hinder growth.

Collateral Requirements: Some lenders may require collateral or personal guarantees, which involve pledging assets or personal liability. Startups should carefully evaluate the potential risks associated with collateral requirements.

So, when is debt financing a good option for your startup?

Debt financing offers startups a viable alternative to equity financing, allowing them to access capital while retaining ownership and control. By understanding the key features, considerations, and potential benefits and challenges associated with debt financing, startups can make informed decisions about their funding strategies. Whether it’s acquiring assets, managing cash flow, or pursuing growth opportunities, debt financing can empower startups to fuel their growth trajectory and achieve their business objectives.

Crowdfunding

Crowdfunding harnesses the power of collective contributions from a large number of individuals, typically through online platforms, to fund entrepreneurial projects. In this blog post, we will delve into the concept of crowdfunding for startups, its significance, key considerations, and the potential benefits and challenges associated with this innovative funding approach.

What is Crowdfunding?

Crowdfunding is a financing model that enables startups to raise capital from a diverse group of individuals, often referred to as “backers” or “contributors,” who believe in the startup’s vision and value proposition. This form of financing occurs through online platforms, where entrepreneurs present their ideas or projects, set funding goals, and offer various incentives or rewards to backers. Crowdfunding campaigns can take different forms, such as donation-based crowdfunding, reward-based crowdfunding, equity crowdfunding, or lending-based crowdfunding, each with its own dynamics and regulatory requirements.

Key Features of Crowdfunding

Broad Access to Capital: Crowdfunding offers startups the opportunity to tap into a vast network of potential backers beyond traditional sources of funding. By leveraging online platforms, startups can access a global pool of individuals who are passionate about supporting innovative projects.

Validation and Market Feedback: Crowdfunding campaigns provide a valuable opportunity for startups to validate their ideas, gauge market interest, and receive feedback from backers. Positive response and engagement from the crowd can serve as an indicator of market demand and help refine the startup’s value proposition.

Diverse Funding Models: Crowdfunding encompasses various funding models, including donation-based crowdfunding, where backers contribute without expecting financial returns, reward-based crowdfunding, where backers receive non-financial rewards or pre-purchase products or services, equity crowdfunding, where backers receive equity or investment stakes, and lending-based crowdfunding, where backers provide loans to startups.

Community Building: Crowdfunding fosters community engagement and allows startups to build a dedicated community of backers who are invested in their success. This community can provide ongoing support, feedback, and act as brand ambassadors, helping to amplify the startup’s reach and impact.

Considerations for Startups Exploring Crowdfunding

Clear Value Proposition: Startups must articulate a compelling value proposition that resonates with potential backers. Clearly communicating the problem being solved, the unique benefits of the product or service, and the potential impact of the startup’s offering is crucial to attracting crowdfunding support.

Platform Selection: Choosing the right crowdfunding platform is essential. Startups should consider factors such as platform reputation, target audience, fees, available funding models, and success stories associated with the platform. Each platform has its own guidelines, requirements, and rules that need to be understood and complied with.

Marketing and Promotion: Running a successful crowdfunding campaign requires effective marketing and promotion efforts. Startups should develop a comprehensive marketing strategy to raise awareness, engage their target audience, and drive traffic to their crowdfunding campaign page.

Fulfillment and Execution: Startups must be prepared to fulfill rewards or obligations promised to backers. Proper planning and execution of delivering rewards, meeting production timelines, and maintaining transparency are critical to building trust with backers.

Benefits and Challenges of Crowdfunding for Startups

Benefits:

Access to Capital: Crowdfunding expands the pool of potential funding sources, allowing startups to access capital that may not be readily available through traditional avenues. It provides an alternative to bank loans, venture capital, or personal investments.

Market Validation: A successful crowdfunding campaign can serve as validation for the startup’s idea or product, demonstrating market demand and attracting the attention of potential investors, partners, or customers.

Early Customer Engagement: Crowdfunding campaigns enable startups to engage early adopters and build a community of backers who become brand advocates, providing valuable feedback and contributing to the startup’s growth.

Challenges:

Campaign Management: Running a crowdfunding campaign requires dedicated effort, strategic planning, and ongoing campaign management. Startups must invest time and resources into creating compelling campaign materials, maintaining engagement with backers, and managing communications.

Target Audience Reach: Despite the potential for a global reach, reaching the target audience and standing out among numerous crowdfunding campaigns can be challenging. Startups must employ effective marketing strategies to capture the attention and interest of potential backers.

Fulfillment Obligations: Successfully delivering on promised rewards or obligations to backers can pose logistical challenges, especially if the campaign experiences high levels of support. Startups should carefully plan their fulfillment processes to avoid delays or disappointment.

So, should you consider crowdfunding for your startup funding needs?

Crowdfunding has transformed the startup funding landscape, providing entrepreneurs with a platform to showcase their ideas, gain validation, and access capital from a global audience of supporters. By leveraging the power of the crowd, startups can not only secure much-needed funding but also engage early adopters, build communities, and refine their value proposition.

However, navigating the crowdfunding landscape requires careful planning, effective marketing, and fulfilling obligations to backers. With the right approach and a compelling campaign, crowdfunding can empower startups to turn their visions into reality and fuel their journey toward success.

Initial Coin Offering (ICO)

In the realm of innovative financing options for startups, Initial Coin Offerings (ICOs) have emerged as a groundbreaking mechanism, revolutionizing the way early-stage companies raise capital. An ICO allows startups to issue and sell digital tokens or coins to investors, providing them with access to unique products, services, or platforms.

Let’s delve into the concept of Initial Coin Offerings, their significance for startups, key considerations, and potential benefits and challenges associated with this novel fundraising approach.

ICO is a natural funding option for most Web3 startups. Within the broader realm of Web3, you have startups that are building products or platforms on Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), Blockchain Infrastructure, Decentralized Identity, Blockchain Gaming, Blockchain Supply Chain etc.

What is an ICO – Initial Coin Offering?

An Initial Coin Offering (ICO) is a fundraising method that leverages blockchain technology to enable startups to raise capital by selling digital tokens or coins to investors. These tokens often represent a utility or functionality within a decentralized platform or ecosystem, and investors acquire them in exchange for cryptocurrencies, such as Bitcoin or Ethereum.

ICOs have gained popularity due to their potential to democratize funding, bypass traditional intermediaries, and offer investors the opportunity to participate in early-stage projects with growth potential.

Key Features of Initial Coin Offerings

Decentralized Fundraising: ICOs operate on decentralized blockchain networks, eliminating the need for traditional intermediaries like banks or venture capital firms. This allows startups to directly engage with investors, democratizing access to capital for a broader range of individuals or organizations.

Token Economy: ICOs typically involve the creation and sale of utility tokens that have specific use cases within the startup’s ecosystem. These tokens can provide access to products, services, or platforms, creating a self-sustaining token economy where value is derived from the network effects and adoption of the platform.

Global Reach: ICOs have a global reach, enabling startups to attract investors from around the world. Through blockchain technology, startups can tap into a global pool of potential investors and contributors, expanding their reach beyond traditional geographic boundaries.

Potential Liquidity: Depending on the token’s design, ICO investors may have the opportunity to trade or sell their tokens on secondary cryptocurrency exchanges, providing potential liquidity and an avenue for early investors to realize gains.

Considerations for Startups Exploring ICOs

Regulatory Environment: The regulatory landscape surrounding ICOs varies across jurisdictions. Startups must navigate and comply with applicable securities regulations, anti-money laundering (AML) laws, and investor protection measures. Engaging legal counsel with expertise in blockchain and cryptocurrency regulations is crucial to ensure compliance.

Transparency and Investor Trust: ICOs operate in a relatively new and rapidly evolving space, which can be prone to scams and fraudulent activities. Building trust with investors requires transparent communication, clear tokenomics, and a well-defined roadmap demonstrating how the raised capital will be utilized to deliver value to token holders.

Technological Infrastructure: Implementing an ICO requires robust blockchain technology infrastructure, including smart contract development, token creation, and secure wallet solutions. Startups must consider the technical expertise and resources required to develop and maintain their blockchain platform.

Benefits and Challenges of ICOs for Startups

Benefits:

Access to Global Capital: ICOs enable startups to reach a global pool of investors, potentially attracting a diverse range of individuals and organizations interested in supporting their project.

Tokenization of Value: By creating utility tokens, startups can design innovative business models, incentivize early adoption, and align the interests of investors and users within their ecosystem.

Early Community Engagement: ICOs provide an opportunity to build an engaged community of supporters, contributors, and early adopters who are passionate about the startup’s vision and can help drive adoption and growth.

Challenges:

Regulatory Uncertainty: The evolving regulatory landscape introduces uncertainties and compliance challenges that startups must navigate to ensure legal compliance and protect investors.

Investor Education: Many potential investors may be unfamiliar with cryptocurrencies, blockchain technology, or the risks associated with ICO investments. Educating investors about the project, its technology, and the potential risks is crucial to attract informed participation.

Market Volatility: Cryptocurrency markets are known for their volatility, which can affect the perceived value of tokens issued through ICOs. Startups must carefully manage and communicate these risks to potential investors.

Should your startup consider ICO or not?

Well, ICO is a natural choice for many Web3 startups, not all though.

Initial Coin Offerings (ICOs) have emerged as a transformative fundraising tool for startups, enabling them to tap into the power of blockchain technology and cryptocurrencies. While ICOs offer unique opportunities for startups to access global capital, engage early adopters, and build token economies, they also come with regulatory complexities and challenges that must be navigated carefully.

By understanding the dynamics of ICOs and employing a thoughtful approach, startups can leverage this innovative funding mechanism to unlock their potential, accelerate growth, and realize their vision in the ever-evolving world of decentralized finance.

Initial Public Offering (IPO)

Simply put, this is where your journey ends as a startup and your journey as a publicly listed corporate begins!

For startups aiming to accelerate growth, access new capital, and gain broader market visibility, the path to becoming a publicly traded company through an Initial Public Offering (IPO) can be an exciting and transformative milestone. An IPO offers startups the opportunity to issue shares to the public and list them on a stock exchange, enabling them to raise substantial funds and provide liquidity to early investors.

Understanding Initial Public Offerings

An Initial Public Offering (IPO) is the process through which a privately held startup transitions into a publicly traded company by selling its shares to the public for the first time. This involves listing the company’s shares on a stock exchange, making them available for trading by investors.

IPOs are typically facilitated by investment banks and involve a rigorous due diligence process, regulatory compliance, and extensive preparation to meet the requirements of public market investors.

Key Features of Initial Public Offerings

Capital Infusion: An IPO allows startups to raise substantial capital by offering shares to the public. This infusion of funds can fuel growth initiatives, such as expanding operations, developing new products, or pursuing acquisitions, enabling startups to scale and compete in the market more effectively.

Enhanced Market Visibility: Going public grants startups increased market visibility and exposure. The IPO process and subsequent listing on a stock exchange provide a platform to showcase the company’s potential, attract institutional investors, and gain credibility among customers, partners, and stakeholders.

Liquidity for Early Investors: Through an IPO, early investors, including founders, employees, and venture capital firms, can sell their shares to the public, providing an opportunity to realize their investments and unlock liquidity. This liquidity event can incentivize early-stage investors and attract new investors to participate in the company’s growth.

Regulatory Compliance and Transparency: As a publicly traded company, startups must adhere to stringent regulatory requirements and financial reporting standards. This commitment to transparency and accountability can build trust with investors, analysts, and the broader market, enhancing the company’s reputation and access to capital in the long term.

Considerations for Startups Exploring IPOs

Financial Readiness: Startups considering an IPO must demonstrate financial readiness, including a solid track record of revenue growth, profitability, and sustainable financial performance. The company’s financial statements and business model must undergo rigorous scrutiny by investment banks and regulators.

Corporate Governance: IPOs require startups to establish strong corporate governance practices to comply with regulatory requirements and address potential conflicts of interest. Implementing effective governance structures, independent boards of directors, and transparent reporting mechanisms is crucial to gaining investor confidence.

Market Timing and Investor Sentiment: The timing of an IPO is crucial. Startups must carefully assess market conditions, investor sentiment, and industry trends to gauge the optimal time for going public. External factors, such as economic conditions and market volatility, can significantly impact the success of an IPO.

Benefits and Challenges of IPOs for Startups

Benefits:

Access to Capital: IPOs provide startups with access to substantial capital from public market investors, enabling them to fund expansion plans, invest in research and development, or pursue strategic acquisitions.

Enhanced Reputation and Credibility: Going public can enhance a startup’s reputation and credibility among customers, partners, and stakeholders. The increased visibility and regulatory compliance associated with being a public company can instill confidence in investors and stakeholders.

Liquidity and Exit Opportunities: An IPO provides liquidity for early investors, allowing them to realize their investments and potentially attract new investors. Additionally, it offers a potential exit opportunity for founders and early employees to monetize their equity holdings.

Challenges:

Regulatory Compliance and Reporting: As a publicly traded company, startups must comply with a wide range of regulatory requirements, including financial reporting, corporate governance, and ongoing disclosure obligations. Meeting these compliance standards can be time-consuming and resource-intensive.

Increased Scrutiny and Expectations: Public companies face heightened scrutiny from investors, analysts, and the media. Startups must manage expectations, deliver consistent financial performance, and meet market expectations to maintain investor confidence and stock price stability.

Loss of Control and Privacy: Going public involves a loss of control for founders and early investors as decision-making becomes subject to shareholder influence. Startups must be prepared for increased transparency, scrutiny, and compliance requirements that may impact operational flexibility and privacy.

An Initial Public Offering (IPO) represents a significant milestone for startups seeking to raise capital, gain market visibility, and unlock liquidity for early investors. By transitioning from a privately held entity to a publicly traded company, startups can access substantial funds, enhance their reputation, and engage with a broader investor base.

However, IPOs also come with rigorous regulatory compliance, increased scrutiny, and the loss of some control. Startups must carefully evaluate their readiness, market conditions, and long-term goals to determine if an IPO aligns with their strategic objectives. When executed successfully, an IPO can pave the way for accelerated growth, market leadership, and long-term sustainability in the dynamic world of entrepreneurship.

Conclusion – Startup Funding Stages Explained

In conclusion, the journey of funding for startups involves several stages, each playing a crucial role in fueling growth, validating ideas, and securing capital. Let’s recap the key stages of funding for a startup that we discussed in this article:

Early Stage

Pre-Seed Funding: The earliest stage where founders use personal savings, friends and family (F&F) investments, or grants to develop their business idea, build prototypes, and conduct market research.

Seed Funding: Startups in this stage receive initial external investments to further develop their product or service, validate the market demand, and build their core team.

Growth Stage

Series A Funding: At this stage, startups have demonstrated potential, achieved early market traction, and are ready to scale. This funding stage helps them expand their operations, scale their business, and enter new markets.

Series B Funding: Startups in the Series B stage have achieved significant growth and are ready to further scale their operations, penetrate new markets, and invest in talent acquisition and product development.

Growth Stage Funding: This stage involves raising capital to accelerate growth, expand into new markets, invest in marketing and sales efforts, and solidify the startup’s position in the industry.

Crowdfunding: Crowdfunding campaigns provide startups with the opportunity to raise funds from a large pool of individual investors, typically through online platforms. It helps engage early adopters, build a community, and validate the market interest in the product or service.

Late Stage

Bridge Financing: Bridge financing provides short-term funding to bridge the gap between funding rounds or to support startups during a challenging period. It helps sustain operations and maintain momentum until the next funding round.

Initial Coin Offering (ICO): ICOs enable startups to raise funds by issuing and selling digital tokens or cryptocurrencies. This funding method is typically used by blockchain-based startups to support the development and launch of their projects.

Debt Financing & Loans: Startups may opt for debt financing, such as loans or lines of credit, to secure capital while minimizing equity dilution. Debt financing allows startups to access funds with the obligation to repay them over time, usually with interest.

Initial Public Offering (IPO): The IPO stage marks the transition of a privately held startup to a publicly traded company. Startups go public to access significant capital, enhance market visibility, and provide liquidity for early investors.

Each funding stage presents its own set of opportunities, challenges, and requirements. Startups must carefully navigate these stages, align their funding strategies with their growth objectives, and leverage the available funding options to propel their success.

By understanding the different startup funding stages and tailoring their approach accordingly, entrepreneurs can increase their chances of securing the necessary capital to realize their visions and achieve sustainable growth.

I hope you enjoyed the article. Share your thoughts and experiences in the comments section.

[…] track record of success and requires funding to scale its products or services. As explained in The Most Complete Guide to Startup Funding Stages in 2023, the process involves significant amounts of money and the addition of venture capitalists as key […]