For early-stage startups, securing funding at the seed stage is a crucial step towards turning an innovative idea into a viable business. Seed funding provides the necessary capital to propel a startup’s growth, validate its market potential, and transform dreams into reality. In this article, we explore the ins and outs of seed round of funding, its significance, and the avenues available for entrepreneurs to obtain this critical initial seed stage investment.

In this post, we'll cover:

What is Seed Funding?

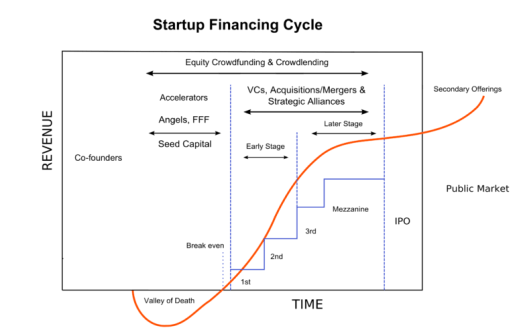

Seed funding represents the first round of external financing that startups seek to raise after exhausting personal savings and contributions from family and friends (which is the pre-seed funding stage). It involves developing a business idea, conducting market research, and building a minimum viable product (MVP).

It is one of the first two stages of startup funding. This stage focuses on nurturing the seed of an idea, allowing entrepreneurs to take the initial steps towards building their product or service. Funding at this stage typically comes from the founders’ personal savings, family and friends, or angel investors. Seed funding is crucial for proof of concept, market validation, and early product development.

Raising Seed Funding – Sources

- Personal Savings: Entrepreneurs often invest their own money to kickstart their ventures. By showing confidence in their idea, they can attract external investors who are more likely to invest when founders have a personal stake. Lately though we’re seeing this into play during the pre-seed funding stage more so than the seed funding stage.

- Family and Friends: The initial network of family and friends can be a valuable source for raising seed funding. These individuals believe in the entrepreneur’s vision and may provide financial support or act as angel investors.

- Angel Investors: Angel investors are high-net-worth individuals who invest their own capital into early-stage startups in exchange for equity. They bring not only financial resources but also industry knowledge, mentorship, and valuable connections.

Importance of Seed Funding

Seed funding plays a vital role in a startup’s journey:

- Proof of Concept: Seed funding enables entrepreneurs to develop a minimum viable product (MVP) and validate their business concept, proving its feasibility and market potential.

- Market Validation: By acquiring early customers or users, startups can demonstrate initial market interest and refine their product based on user feedback.

- Team Building: Although we don’t recommend hiring this early at this stage, seed funding can help your startup attract top talent by providing resources to hire skilled employees, fostering growth and innovation.

- Early Growth: With seed funding, startups can invest in marketing, customer acquisition, and operational infrastructure to fuel initial growth and gain a competitive edge.

Pitching to Investors for Seed Funding

To secure seed funding, startups must effectively pitch their ideas to potential investors. Here are key elements to consider:

- Clear Value Proposition: Clearly articulate the problem your startup solves and how your product or service provides a unique solution.

- Market Analysis: Showcase a thorough understanding of the target market, its size, growth potential, and competitive landscape.

- Strong Team: Investors look for a dedicated and capable team with relevant expertise and a track record of success.

- Scalability and Potential Returns: Highlight the scalability of your business model and the potential for significant returns on investment.

Alternative Funding Options

Apart from traditional seed funding sources, startups can explore other avenues:

- Incubators and Accelerators: Joining startup incubators like StartupGuru or accelerators provides not only funding but also mentorship, resources, and networking opportunities. Fun fact: StartupGuru is one of its kind, fully remote and equity free incubation program for early-stage startups and non-technical founders. Check out the program and apply if you find it a fit to accelerate your journey from idea to your early validations.

- Crowdfunding: Platforms like Kickstarter and Indiegogo allow startups to raise funds from a large number of individuals who believe in their vision.

- Grants and Competitions: Government grants, research grants, and startup competitions offer non-dilutive funding options for early-stage startups.

Effective Strategies for Securing Seed Funding

Securing seed funding is a critical milestone for early-stage startups. While the process can be challenging, implementing effective strategies can significantly increase your chances of attracting investors. Here are some key strategies to consider when seeking seed funding:

Refine Your Business Plan

Crafting a well-defined and compelling business plan is crucial. Clearly articulate your startup’s value proposition, target market, competitive advantage, and growth potential. Investors want to see a solid business model and a clear roadmap for success.

Develop a Minimum Viable Product (MVP)

Building a functional MVP demonstrates your startup’s ability to execute its vision. Investors want to see tangible evidence of your product or service’s potential and market fit. Focus on developing a prototype that showcases the core features and value proposition to gain early customer feedback.

Build a Strong Team

Investors not only invest in ideas but also in the people behind them. Assemble a talented and experienced team that complements your skills and brings diverse expertise to the table. A strong team inspires confidence and increases the likelihood of attracting seed funding.

Leverage Your Network

Leverage your personal and professional network to connect with potential investors, mentors, and advisors. Attend startup events, pitch competitions, and networking forums to expand your reach. Building relationships and tapping into existing connections can lead to valuable introductions and funding opportunities.

Seek Angel Investors and Micro VCs

Angel investors and micro venture capital firms often focus on early-stage startups and are more willing to take risks. Research and target investors who have a track record of investing in your industry or similar startups. Customize your pitch to align with their investment preferences and demonstrate how your startup fits their portfolio.

Explore Incubators and Accelerators

Consider joining reputable startup incubators or accelerators. These programs provide not only funding but also mentorship, resources, and valuable connections. Incubators and accelerators can significantly enhance your startup’s credibility and increase visibility among potential investors.

Demonstrate Market Traction

Investors want to see evidence of market demand and customer validation. Acquire early customers, generate revenue, and showcase metrics such as user growth, engagement, or market share. Tangible market traction can differentiate your startup and make it more attractive to investors.

Prepare a Compelling Pitch

Craft a concise and compelling pitch deck that effectively communicates your startup’s value proposition, market opportunity, competitive advantage, and financial projections. Tailor your pitch to each investor, highlighting how their investment aligns with your startup’s goals and how you plan to achieve profitability.

Be Open to Feedback and Iteration

Receiving feedback from investors is invaluable. Listen attentively, be open to suggestions, and demonstrate your willingness to adapt and iterate. Investors appreciate founders who are receptive to feedback and demonstrate a growth mindset.

Remember, securing seed funding requires persistence, resilience, and a well-executed strategy. By refining your business plan, leveraging your network, and showcasing market traction, you can position your startup as an attractive investment opportunity and increase your chances of securing the funding you need to propel your entrepreneurial journey forward.

Conclusion – Startup Seed Financing

Seed funding is the lifeline for early-stage startups, fueling their growth and laying the foundation for future success. By securing seed funding, entrepreneurs can validate their ideas, build a strong team, and drive initial market traction. With a compelling pitch, a clear value proposition, and a well-defined growth strategy, startups can attract the necessary capital and support to bring their vision to life. Remember, seed funding is not just about money but also about finding strategic partners who share your passion for innovation and can help guide your startup on its journey towards success.